Navigating Qualified Dividends and Capital Gain Tax Rates

Understanding the Basics of Qualified Dividends and Capital Gain Tax Rates

As an investor, it’s essential to understand the tax implications of your investments. Two critical components of investment taxation are qualified dividends and capital gain tax rates. In this article, we’ll delve into the world of qualified dividends and capital gain tax rates, exploring the basics, how they work, and strategies to minimize your tax liability.

What are Qualified Dividends?

Qualified dividends are a type of dividend that is subject to a lower tax rate. To qualify, the dividend must meet specific requirements:

- Stock ownership: You must have held the stock for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

- Dividend payment: The dividend must be paid by a U.S. corporation or a qualified foreign corporation.

- Tax rate: The dividend must be subject to a lower tax rate, typically 0%, 15%, or 20%.

What are Capital Gain Tax Rates?

Capital gain tax rates apply to the profit made from the sale of an investment, such as stocks, bonds, or real estate. There are two types of capital gains:

- Short-term capital gains: Gains from investments held for one year or less.

- Long-term capital gains: Gains from investments held for more than one year.

Capital gain tax rates vary based on your income tax bracket and the type of investment:

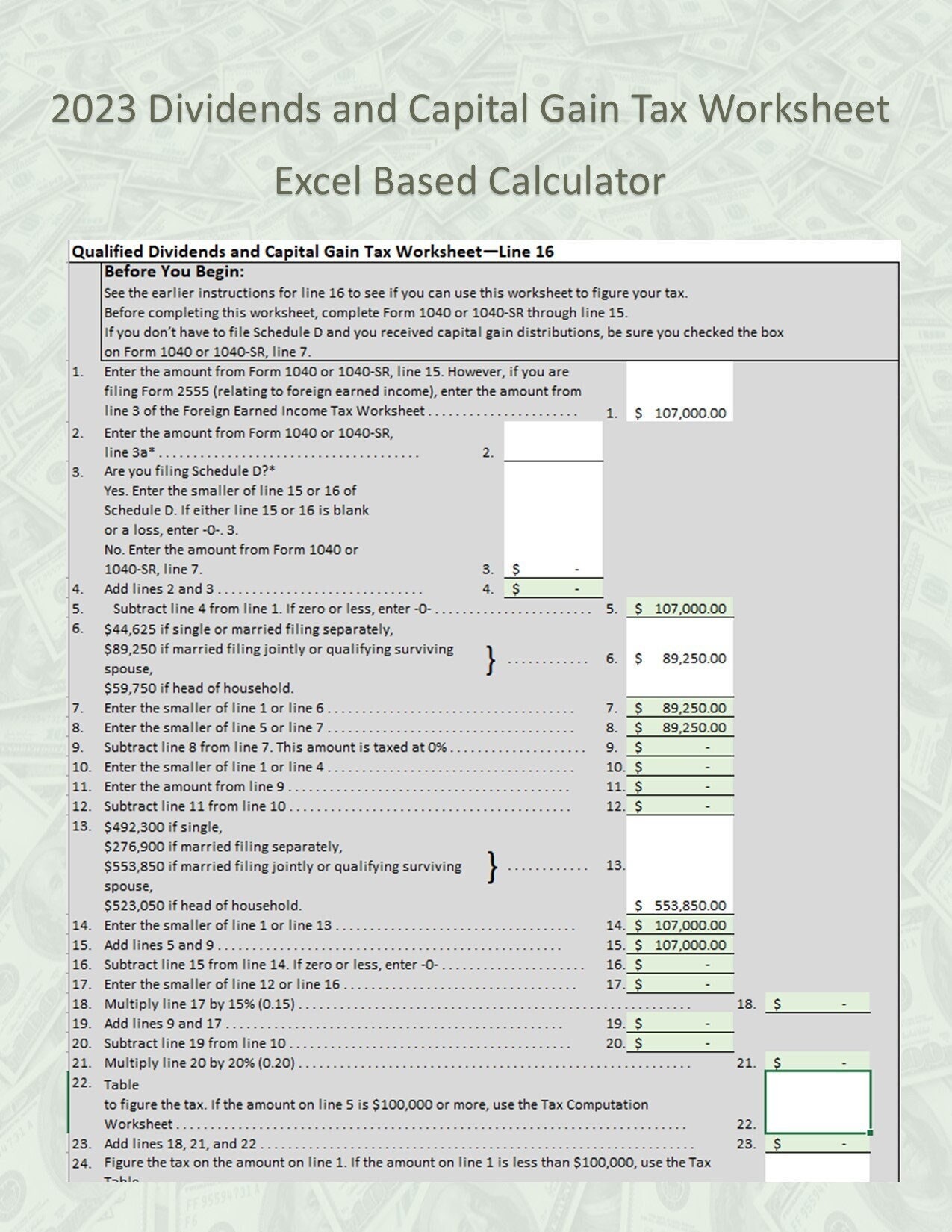

| Taxable Income | Long-term Capital Gain Tax Rate |

|---|---|

| 0 - 40,000 | 0% |

| 40,001 - 441,450 | 15% |

| $441,451 and above | 20% |

How do Qualified Dividends and Capital Gain Tax Rates Work Together?

When you sell an investment, you may be subject to both qualified dividends and capital gain tax rates. For example:

- You sell a stock for a profit, and you’ve held it for more than one year. You’ll pay long-term capital gain tax rates on the profit.

- You receive a dividend from a stock you’ve held for at least 61 days. You’ll pay qualified dividend tax rates on the dividend.

Strategies to Minimize Tax Liability

To minimize your tax liability, consider the following strategies:

- Hold investments for more than one year: This will qualify you for long-term capital gain tax rates, which are generally lower than short-term rates.

- Invest in tax-efficient funds: Look for funds with low turnover rates, as these tend to generate fewer capital gains distributions.

- Harvest losses: If you have investments that have declined in value, consider selling them to offset gains from other investments.

- Consider tax-loss swapping: If you have an investment that has declined in value, consider selling it and replacing it with a similar investment to avoid washing sale rules.

📝 Note: Tax laws and regulations are subject to change. It's essential to consult with a tax professional or financial advisor to ensure you're making the most tax-efficient decisions for your specific situation.

Conclusion

Navigating qualified dividends and capital gain tax rates can be complex, but understanding the basics and strategies to minimize tax liability can help you make informed investment decisions. By holding investments for more than one year, investing in tax-efficient funds, harvesting losses, and considering tax-loss swapping, you can reduce your tax liability and maximize your investment returns.

What is the difference between qualified dividends and ordinary dividends?

+Qualified dividends are subject to a lower tax rate, typically 0%, 15%, or 20%, while ordinary dividends are taxed as ordinary income.

How do I know if I’m eligible for qualified dividend tax rates?

+You must have held the stock for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date, and the dividend must be paid by a U.S. corporation or a qualified foreign corporation.

What is the tax rate on long-term capital gains?

+The tax rate on long-term capital gains varies based on your income tax bracket, with rates of 0%, 15%, or 20%.

Related Terms:

- Foreign Earned income tax Worksheet

- Schedule D Tax Worksheet

- 28% Rate Gain Worksheet

- Capital gains worksheet

- IRS qualified dividends tax rate