5 Ways to Maximize Oregon Personal Allowances

Oregon personal allowances can be a valuable tax benefit for residents of the state. However, many taxpayers may not be aware of the various ways to maximize these allowances. In this article, we will explore five ways to maximize Oregon personal allowances and reduce your tax liability.

Understanding Oregon Personal Allowances

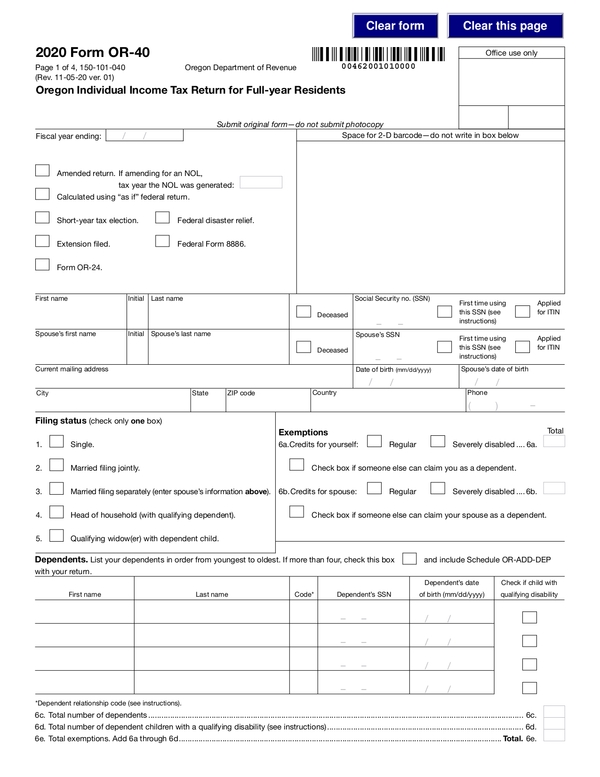

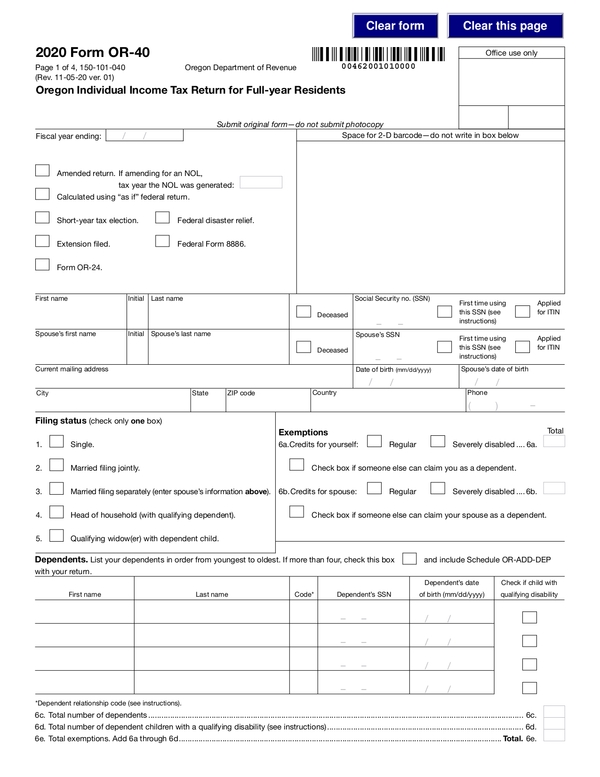

Before we dive into the ways to maximize Oregon personal allowances, it’s essential to understand what they are and how they work. Personal allowances are deductions that can be claimed on your Oregon state tax return to reduce your taxable income. The state of Oregon allows taxpayers to claim a standard deduction or itemize their deductions, whichever is greater.

1. Claim the Standard Deduction

The standard deduction is a fixed amount that can be claimed by all taxpayers, regardless of their income level or filing status. For the 2022 tax year, the standard deduction in Oregon is 2,270 for single filers and 4,545 for joint filers. Claiming the standard deduction can be a simple and straightforward way to maximize your Oregon personal allowances.

📝 Note: The standard deduction may be adjusted annually for inflation, so be sure to check the Oregon Department of Revenue website for the latest information.

2. Itemize Your Deductions

If you have significant expenses throughout the year, itemizing your deductions may be a better option. Itemized deductions can include expenses such as:

- Medical expenses

- Mortgage interest

- Property taxes

- Charitable donations

To itemize your deductions, you will need to complete Schedule A of the Oregon state tax return and attach it to your tax return. Be sure to keep receipts and documentation for all of your itemized deductions, as you may be required to provide proof of these expenses if audited.

3. Claim the Oregon Renters' Credit

If you rent your primary residence in Oregon, you may be eligible for the Oregon Renters’ Credit. This credit can provide a refundable credit of up to 150 for single filers and 300 for joint filers. To qualify for the credit, you must meet certain income and rent payment requirements.

| Income Level | Rent Payment Requirement |

|---|---|

| Single filers: $20,000 or less | $1,000 or more in rent payments |

| Joint filers: $30,000 or less | $1,500 or more in rent payments |

4. Claim the Oregon Earned Income Tax Credit (EITC)

The Oregon EITC is a refundable credit that can provide a significant tax benefit to low- and moderate-income working individuals and families. To qualify for the credit, you must meet certain income and eligibility requirements.

- Income level: $50,000 or less

- Filing status: Single, married filing jointly, or head of household

- Work requirements: You must have earned income from a job and meet certain work requirements

5. Consult with a Tax Professional

Finally, consulting with a tax professional can be a great way to maximize your Oregon personal allowances. A tax professional can help you navigate the complexities of the Oregon tax code and ensure that you are claiming all of the deductions and credits that you are eligible for.

By following these five tips, you can maximize your Oregon personal allowances and reduce your tax liability. Remember to stay informed about changes to the Oregon tax code and to consult with a tax professional if you have any questions or concerns.

Oregon personal allowances can be a valuable tax benefit for residents of the state. By understanding how to maximize these allowances, you can reduce your tax liability and keep more of your hard-earned money.

What is the standard deduction in Oregon?

+The standard deduction in Oregon is 2,270 for single filers and 4,545 for joint filers.

Can I claim the Oregon Renters’ Credit if I own my home?

+No, the Oregon Renters’ Credit is only available to renters who meet certain income and rent payment requirements.

How do I claim the Oregon Earned Income Tax Credit (EITC)?

+To claim the Oregon EITC, you must meet certain income and eligibility requirements and complete the necessary forms and schedules on your Oregon state tax return.