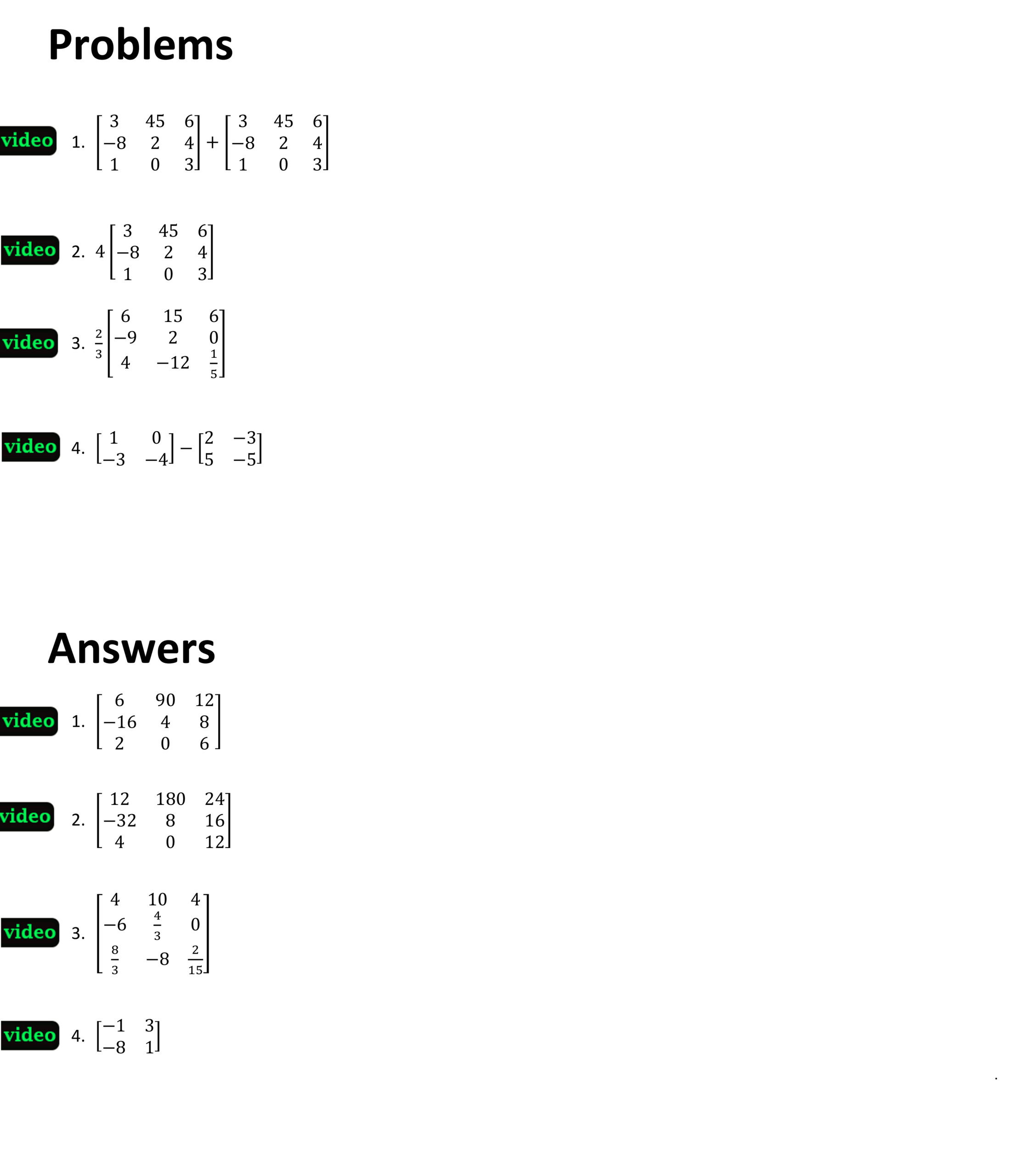

Moore Marsden Calculation Worksheet

Moore Marsden Calculation Worksheet: A Comprehensive Guide

As a professional in the field of finance, you may have come across the Moore Marsden calculation method. This technique is widely used to calculate the value of a business, particularly in the context of divorce proceedings. In this article, we will delve into the details of the Moore Marsden calculation worksheet, providing you with a comprehensive guide on how to use it effectively.

What is the Moore Marsden Calculation?

The Moore Marsden calculation is a method used to determine the value of a business, taking into account various factors such as income, expenses, and goodwill. This technique is commonly employed in divorce cases to establish the value of a business, which can then be used to determine the equitable distribution of assets.

Understanding the Moore Marsden Calculation Worksheet

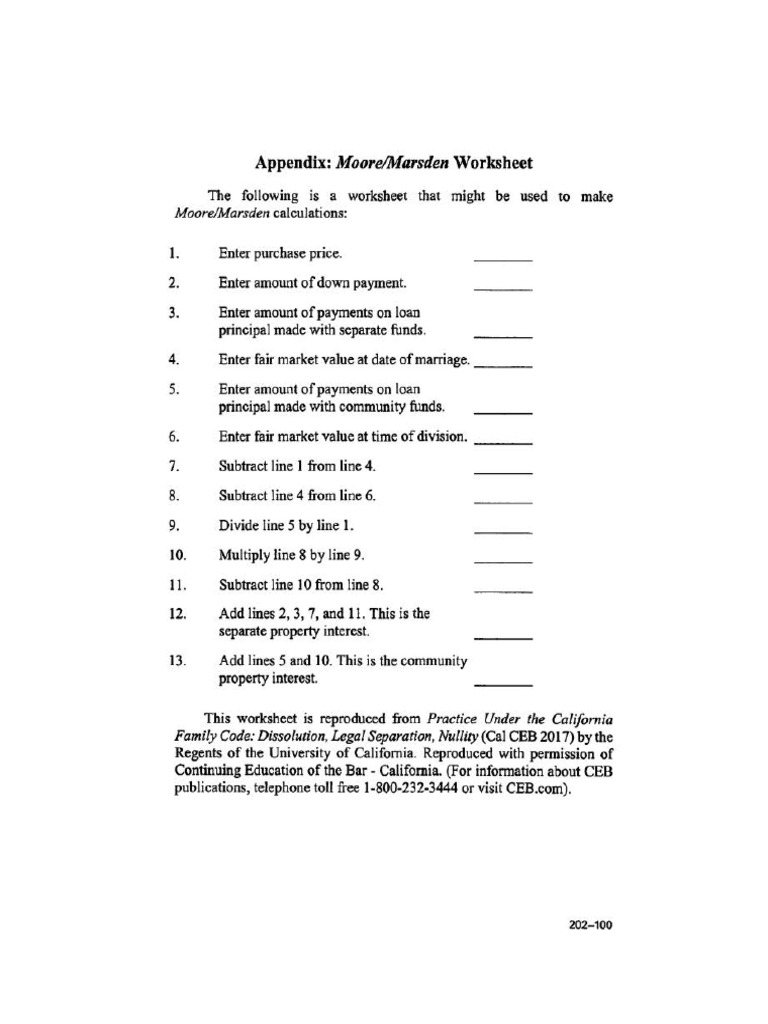

The Moore Marsden calculation worksheet is a tool used to calculate the value of a business using the Moore Marsden method. The worksheet typically consists of several sections, each designed to capture specific data points relevant to the calculation.

Section 1: Business Information

| Category | Description |

|---|---|

| Business Name | Name of the business |

| Business Type | Type of business (e.g., sole proprietorship, partnership, corporation) |

| Year Established | Year the business was established |

Section 2: Income Statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Revenue | |||

| Cost of Goods Sold | |||

| Operating Expenses | |||

| Net Income |

Section 3: Balance Sheet

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Liabilities | |||

| Equity |

Section 4: Goodwill Calculation

| Category | Description |

|---|---|

| Goodwill Value | Value of goodwill (calculated using a multiplier) |

How to Use the Moore Marsden Calculation Worksheet

To use the Moore Marsden calculation worksheet, follow these steps:

- Gather financial data: Collect financial statements, including income statements and balance sheets, for the business.

- Complete Section 1: Enter the business name, type, and year established.

- Complete Section 2: Enter the income statement data for the past three years.

- Complete Section 3: Enter the balance sheet data for the past three years.

- Calculate goodwill: Use a multiplier to calculate the value of goodwill.

- Calculate business value: Use the Moore Marsden formula to calculate the value of the business.

Moore Marsden Formula:

Business Value = (Net Income x Multiplier) + Goodwill Value

Multiplier:

The multiplier is a factor used to calculate the value of the business. The multiplier can vary depending on the industry, size, and profitability of the business.

📝 Note: The multiplier is typically between 1-3, with 2 being the most common.

Example Calculation

Let’s say we have a business with the following financial data:

Section 2: Income Statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Revenue | $100,000 | $120,000 | $150,000 |

| Cost of Goods Sold | $50,000 | $60,000 | $70,000 |

| Operating Expenses | $20,000 | $25,000 | $30,000 |

| Net Income | $30,000 | $35,000 | $50,000 |

Section 3: Balance Sheet

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | $200,000 | $250,000 | $300,000 |

| Liabilities | $100,000 | $120,000 | $150,000 |

| Equity | $100,000 | $130,000 | $150,000 |

Section 4: Goodwill Calculation

| Category | Description |

|---|---|

| Goodwill Value | $50,000 (calculated using a multiplier of 2) |

Using the Moore Marsden formula, we can calculate the business value as follows:

Business Value = (Net Income x Multiplier) + Goodwill Value = (50,000 x 2) + 50,000 = 100,000 + 50,000 = $150,000

Conclusion

The Moore Marsden calculation worksheet is a valuable tool for calculating the value of a business. By following the steps outlined in this guide, you can use the worksheet to determine the value of a business, taking into account various factors such as income, expenses, and goodwill. Remember to use the correct multiplier and to calculate goodwill accurately to ensure an accurate business valuation.

What is the Moore Marsden calculation method?

+The Moore Marsden calculation method is a technique used to calculate the value of a business, taking into account various factors such as income, expenses, and goodwill.

What is the purpose of the Moore Marsden calculation worksheet?

+The Moore Marsden calculation worksheet is a tool used to calculate the value of a business using the Moore Marsden method.

How do I calculate goodwill using the Moore Marsden method?

+Goodwill is calculated using a multiplier, typically between 1-3, with 2 being the most common.

Related Terms:

- Moore Marsden calculator

- Moore Marsden calculator with refinance

- moore-marsden calculation california

- Moore/Marsden calculation example

- Reverse Moore Marsden calculation

- moore/marsden vs 2640