5 Easy Steps to Calculate Mgic W2 Income

Understanding Mgic W2 Income and Its Calculation

Calculating Mgic W2 income is a crucial step for individuals who have investments in mortgage insurance, particularly those who have dealings with MGIC Investment Corporation. Mgic W2 income refers to the income earned from MGIC investments, and it’s essential to report this income accurately on your tax returns. In this article, we will guide you through 5 easy steps to calculate Mgic W2 income.

Step 1: Gather Necessary Documents

To start calculating your Mgic W2 income, you’ll need to gather the following documents:

- Your MGIC investment statements

- Your W2 forms from MGIC

- Any other relevant tax documents

These documents will provide you with the necessary information to calculate your Mgic W2 income accurately.

Step 2: Identify the Mgic W2 Income Type

MGIC investments can generate different types of income, including:

- Dividend income: This is the most common type of Mgic W2 income. Dividends are payments made by MGIC to its shareholders.

- Interest income: This type of income is earned on MGIC bonds or other debt securities.

- Capital gains: This type of income is earned when you sell MGIC shares or securities for a profit.

Identify the type of Mgic W2 income you’ve earned, as this will affect how you calculate and report it on your tax return.

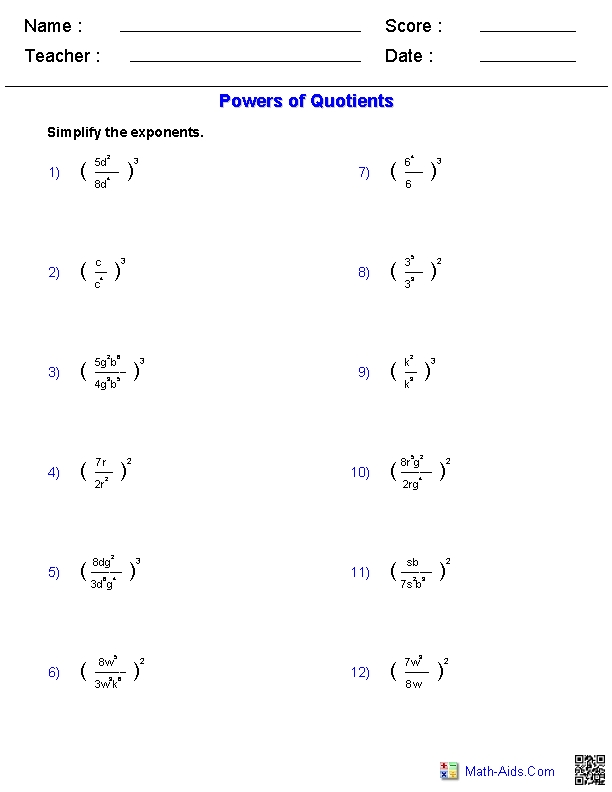

Step 3: Calculate Mgic W2 Income

Now that you have the necessary documents and have identified the type of Mgic W2 income, it’s time to calculate it. Here are the steps:

- For dividend income, multiply the number of shares you own by the dividend rate per share.

- For interest income, multiply the principal amount by the interest rate.

- For capital gains, subtract the cost basis from the sale price of the shares or securities.

For example, let’s say you own 100 shares of MGIC stock and the dividend rate is $0.50 per share. Your dividend income would be:

100 shares x 0.50 per share = 50

📝 Note: Keep in mind that these calculations are simplified examples and may not reflect your actual Mgic W2 income.

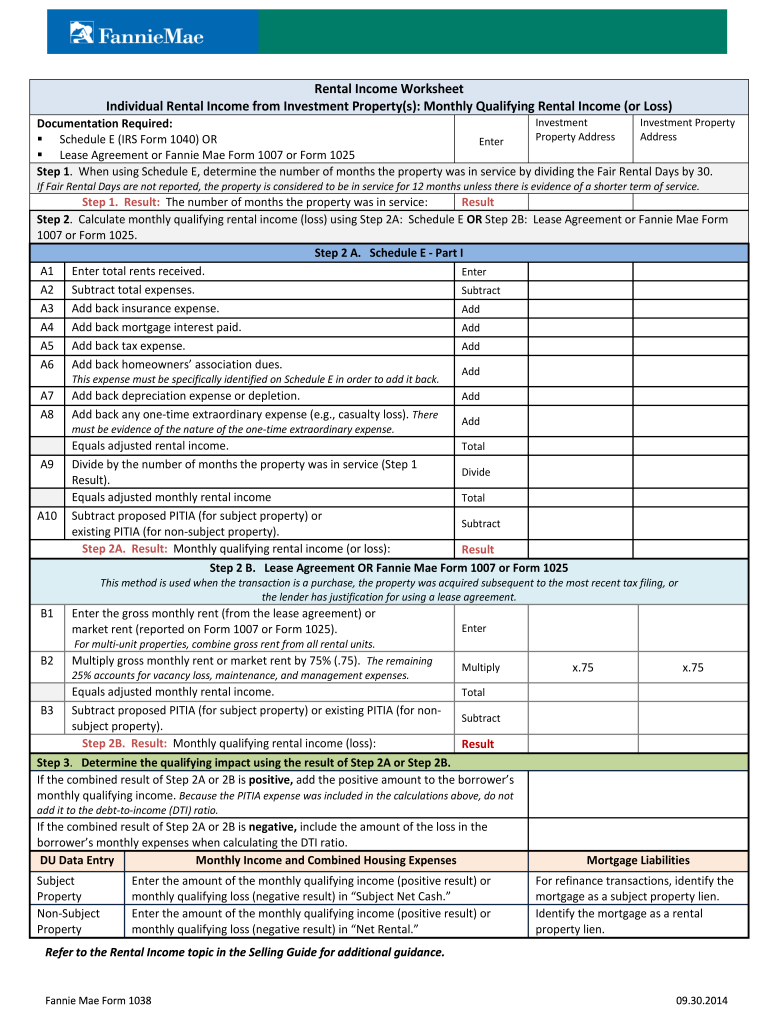

Step 4: Report Mgic W2 Income on Your Tax Return

Once you’ve calculated your Mgic W2 income, it’s time to report it on your tax return. You’ll need to report this income on the following forms:

- Schedule 1 (Form 1040): Report dividend income on Line 3a.

- Schedule B (Form 1040): Report interest income on Line 1.

- Schedule D (Form 1040): Report capital gains on Line 13.

Make sure to follow the instructions on each form carefully and accurately report your Mgic W2 income.

Step 5: Keep Accurate Records

Finally, it’s essential to keep accurate records of your Mgic W2 income, including:

- Your MGIC investment statements

- Your W2 forms from MGIC

- Your tax returns

These records will help you track your income and ensure you’re accurately reporting it on your tax returns.

What is Mgic W2 income?

+Mgic W2 income refers to the income earned from MGIC investments, including dividend income, interest income, and capital gains.

How do I report Mgic W2 income on my tax return?

+You'll need to report Mgic W2 income on the following forms: Schedule 1 (Form 1040) for dividend income, Schedule B (Form 1040) for interest income, and Schedule D (Form 1040) for capital gains.

What records do I need to keep for Mgic W2 income?

+You should keep accurate records of your MGIC investment statements, W2 forms from MGIC, and tax returns.

In conclusion, calculating Mgic W2 income is a straightforward process that requires gathering necessary documents, identifying the type of income, calculating the income, reporting it on your tax return, and keeping accurate records. By following these 5 easy steps, you’ll be able to accurately calculate and report your Mgic W2 income on your tax return.

Related Terms:

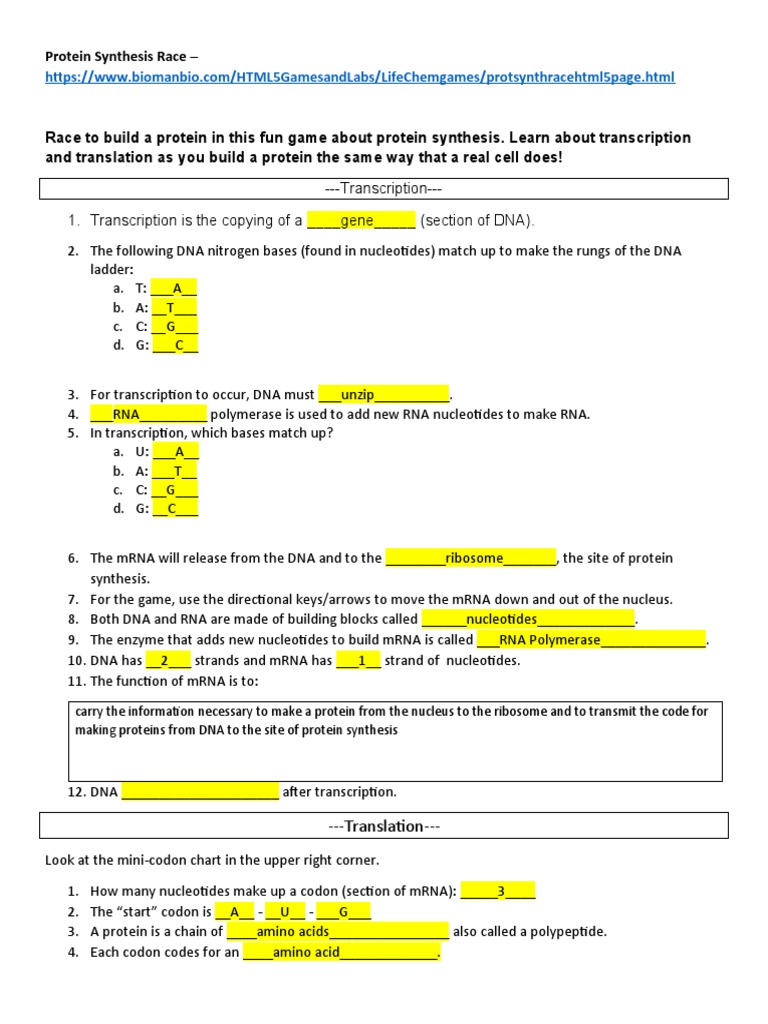

- Mgic "W2" Income Calculation Worksheet

- Income Calculation Worksheet PDF

- Income calculation Worksheet MGIC

- Income calculation worksheet Excel

- self-employed income calculation worksheet excel

- 1120S income calculation worksheet