Teaching Kids About Money Worksheets Made Easy

Why Teaching Kids About Money is Important

In today’s world, managing finances effectively is a crucial life skill that every individual should possess. Teaching kids about money from a young age can help them develop good financial habits, make informed decisions, and achieve financial stability in the long run. As a parent or educator, it’s essential to introduce kids to basic money concepts in a fun and engaging way. One effective way to do this is by using worksheets specifically designed for teaching kids about money.

Benefits of Using Worksheets to Teach Kids About Money

Worksheets can be a valuable tool in teaching kids about money, offering several benefits, including:

- Structured learning: Worksheets provide a structured approach to learning, helping kids understand complex money concepts in a step-by-step manner.

- Reinforces understanding: Worksheets can help reinforce kids’ understanding of money concepts, making it easier for them to retain the information.

- Develops critical thinking: Worksheets can encourage critical thinking and problem-solving skills, helping kids apply money concepts to real-life scenarios.

- Easy to use: Worksheets are easy to use and can be adapted to suit different age groups and learning styles.

Types of Worksheets for Teaching Kids About Money

There are various types of worksheets that can be used to teach kids about money, including:

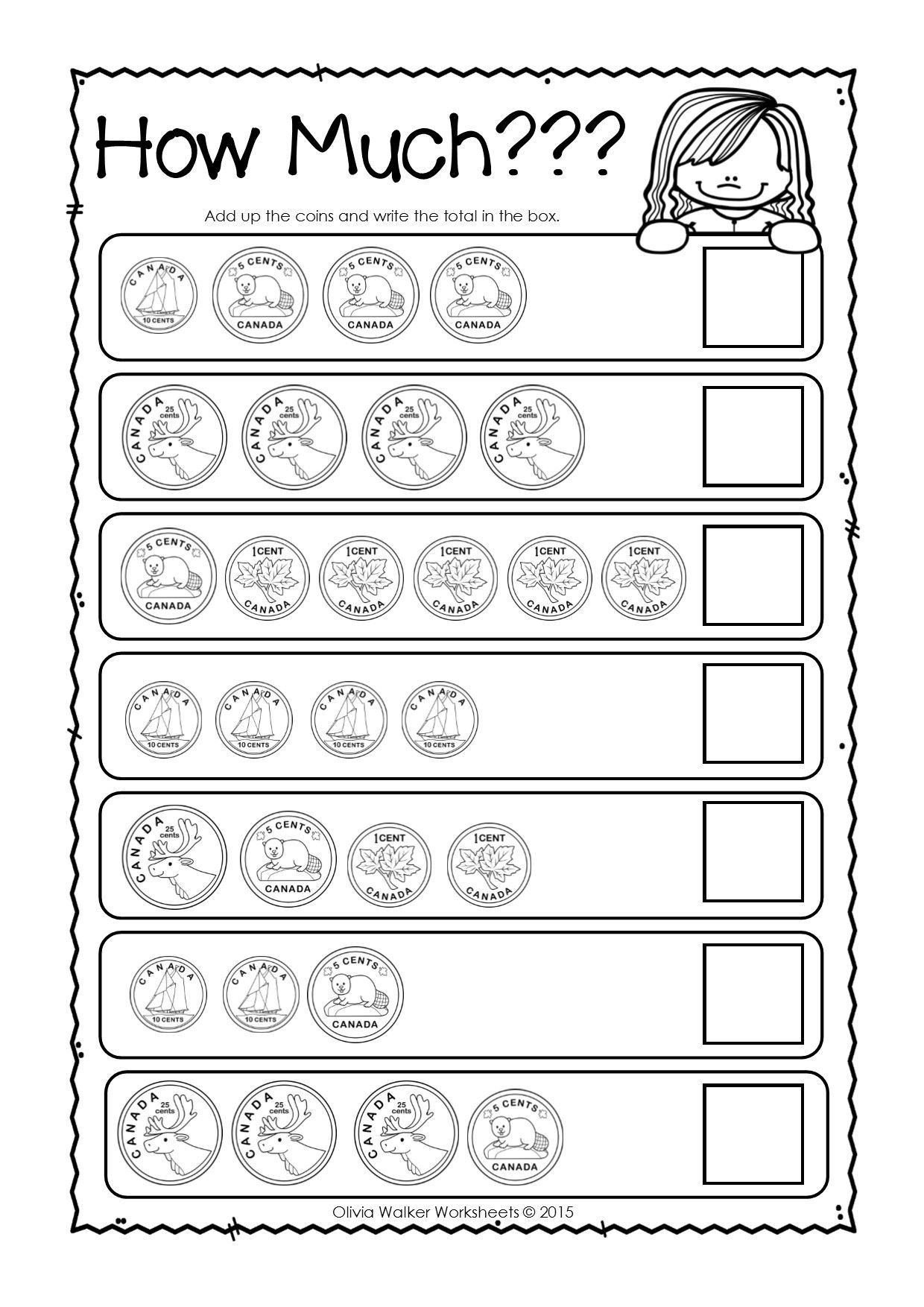

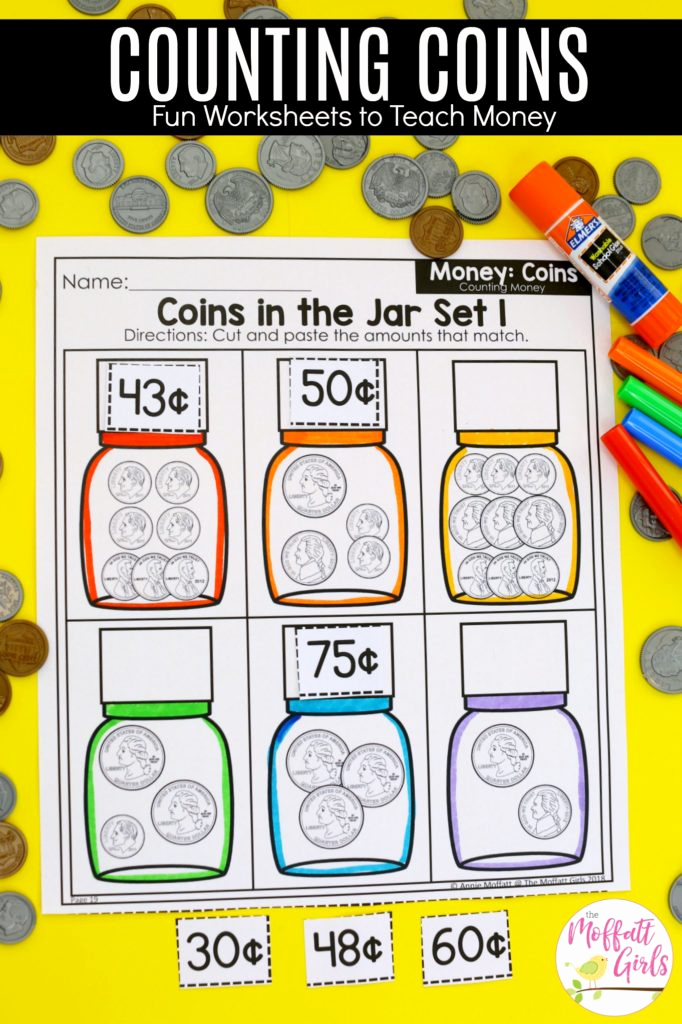

- Counting money worksheets: These worksheets help kids learn to count money, including coins and bills.

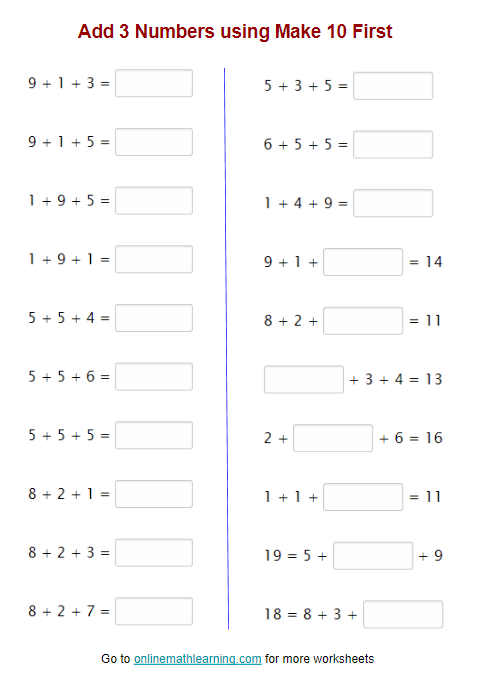

- Basic addition and subtraction worksheets: These worksheets help kids practice basic math operations using money-related scenarios.

- Budgeting worksheets: These worksheets teach kids how to create a simple budget and prioritize spending.

- Needs vs. wants worksheets: These worksheets help kids distinguish between needs and wants, making informed spending decisions.

Creating Your Own Worksheets

While there are many pre-made worksheets available online, creating your own worksheets can be a fun and rewarding experience. Here are some steps to follow:

- Determine the age group: Identify the age group you’re creating the worksheet for and tailor the content accordingly.

- Choose a topic: Select a specific money topic you want to cover, such as counting money or budgeting.

- Keep it simple: Use simple language and concepts to ensure the worksheet is easy to understand.

- Make it engaging: Incorporate images, games, or activities to make the worksheet more engaging.

- Test and refine: Test the worksheet with a small group of kids and refine it based on feedback.

📝 Note: When creating your own worksheets, make sure to keep them concise and easy to follow. Avoid overwhelming kids with too much information.

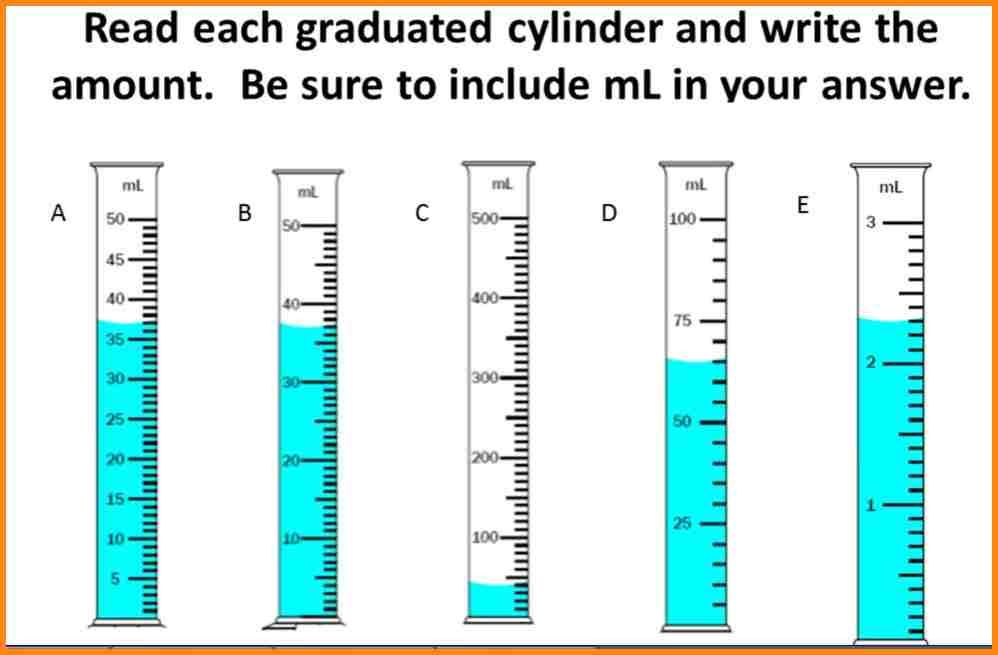

Example Worksheet: Counting Money

| Coins | Value |

|---|---|

| Penny | $0.01 |

| Nickel | $0.05 |

| Dime | $0.10 |

| Quarter | $0.25 |

Instructions: Count the total value of the coins in each row.

Common Mistakes to Avoid When Teaching Kids About Money

When teaching kids about money, it’s essential to avoid common mistakes that can lead to misconceptions and poor financial habits. Some common mistakes to avoid include:

- Not starting early enough: Delaying money education can lead to poor financial habits and a lack of understanding.

- Focusing too much on saving: While saving is essential, it’s equally important to teach kids about spending and budgeting.

- Not leading by example: Kids learn from what they see, so it’s crucial to model good financial behavior.

- Using complicated language: Avoid using complex financial jargon that can confuse kids.

📝 Note: Be patient and consistent when teaching kids about money. It's a process that takes time and practice.

As kids grow and develop, so do their financial needs. By introducing them to basic money concepts early on and using worksheets to reinforce their understanding, you’ll be setting them up for a lifetime of financial stability and success.

In summary, teaching kids about money is a crucial life skill that requires patience, consistency, and the right tools. By using worksheets and avoiding common mistakes, you can help kids develop good financial habits and achieve financial stability in the long run.

What is the best age to start teaching kids about money?

+The best age to start teaching kids about money is as early as 3-4 years old. At this age, kids can start learning basic money concepts, such as counting coins and understanding the value of money.

What are some common mistakes to avoid when teaching kids about money?

+Some common mistakes to avoid when teaching kids about money include not starting early enough, focusing too much on saving, not leading by example, and using complicated language.

How can I make teaching kids about money fun and engaging?

+Some ways to make teaching kids about money fun and engaging include using games, activities, and real-life scenarios to illustrate money concepts. You can also use worksheets, quizzes, and challenges to make learning more interactive.

Related Terms:

- Math grade 1 money worksheets

- Worksheet money grade 2

- Money Rupiah Worksheet

- Counting Worksheet for preschool

- Money grade 3 Worksheet

- Worksheet Number for kindergarten