5 Ways to Complete IRS Credit Limit Worksheet

Understanding the IRS Credit Limit Worksheet

The IRS Credit Limit Worksheet is a crucial tool for individuals and businesses to calculate their allowable credit limit for general business credits. This worksheet is essential for taxpayers who want to claim credits for activities such as research and development, low-income housing, and renewable energy production. In this article, we will discuss five ways to complete the IRS Credit Limit Worksheet accurately and efficiently.

Method 1: Using the IRS Form 3800

The most straightforward way to complete the IRS Credit Limit Worksheet is by using IRS Form 3800, General Business Credit. This form provides a step-by-step guide to calculating the allowable credit limit. To complete the worksheet using Form 3800, follow these steps:

- Start by listing all the general business credits you are claiming, such as the research credit, low-income housing credit, and renewable energy production credit.

- Calculate the total amount of credits claimed by adding up the amounts from each credit.

- Enter the total amount of credits claimed on Line 1 of the worksheet.

- Calculate the tentative credit limit by multiplying the total amount of credits claimed by the applicable credit limit percentage (usually 25% or 30%).

- Enter the tentative credit limit on Line 2 of the worksheet.

- Calculate the allowable credit limit by subtracting any limitations or reductions from the tentative credit limit.

- Enter the allowable credit limit on Line 3 of the worksheet.

📝 Note: Make sure to follow the instructions provided in the Form 3800 instructions to ensure accurate calculation of the credit limit.

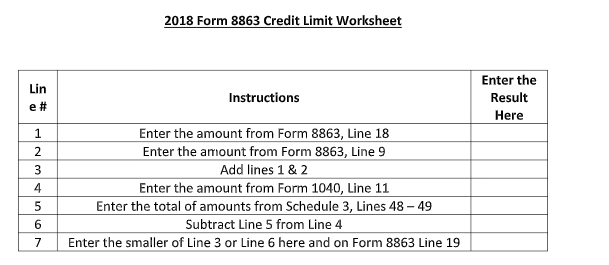

Method 2: Using the IRS Credit Limit Worksheet Template

The IRS provides a Credit Limit Worksheet template that can be used to calculate the allowable credit limit. This template is available on the IRS website and can be downloaded in PDF format. To complete the worksheet using the template, follow these steps:

- Download the Credit Limit Worksheet template from the IRS website.

- Enter the total amount of credits claimed in the first column of the worksheet.

- Calculate the tentative credit limit by multiplying the total amount of credits claimed by the applicable credit limit percentage.

- Enter the tentative credit limit in the second column of the worksheet.

- Calculate the allowable credit limit by subtracting any limitations or reductions from the tentative credit limit.

- Enter the allowable credit limit in the third column of the worksheet.

Method 3: Using Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can also be used to complete the IRS Credit Limit Worksheet. These software programs provide a step-by-step guide to calculating the allowable credit limit and can help ensure accuracy. To complete the worksheet using tax preparation software, follow these steps:

- Select the general business credits you are claiming from the software’s menu.

- Enter the total amount of credits claimed and the applicable credit limit percentage.

- The software will calculate the tentative credit limit and allowable credit limit automatically.

- Review the calculations to ensure accuracy.

Method 4: Consulting with a Tax Professional

If you are unsure about how to complete the IRS Credit Limit Worksheet or need help with complex calculations, consider consulting with a tax professional. A tax professional can provide guidance on how to calculate the allowable credit limit and ensure that you are taking advantage of all the credits available to you.

Method 5: Using a Spreadsheet

For those who are comfortable with spreadsheets, creating a custom worksheet can be an effective way to calculate the allowable credit limit. To complete the worksheet using a spreadsheet, follow these steps:

- Create a table with columns for the total amount of credits claimed, tentative credit limit, and allowable credit limit.

- Enter the total amount of credits claimed in the first column.

- Calculate the tentative credit limit by multiplying the total amount of credits claimed by the applicable credit limit percentage.

- Enter the tentative credit limit in the second column.

- Calculate the allowable credit limit by subtracting any limitations or reductions from the tentative credit limit.

- Enter the allowable credit limit in the third column.

| Total Amount of Credits Claimed | Tentative Credit Limit | Allowable Credit Limit |

|---|---|---|

| $10,000 | $2,500 (25% of $10,000) | $2,000 (after subtracting limitations) |

By following these five methods, taxpayers can accurately and efficiently complete the IRS Credit Limit Worksheet and ensure that they are taking advantage of all the credits available to them.

In summary, completing the IRS Credit Limit Worksheet is a crucial step in claiming general business credits. By using the IRS Form 3800, Credit Limit Worksheet template, tax preparation software, consulting with a tax professional, or creating a custom spreadsheet, taxpayers can ensure accuracy and maximize their credits.

What is the purpose of the IRS Credit Limit Worksheet?

+The IRS Credit Limit Worksheet is used to calculate the allowable credit limit for general business credits, such as research and development, low-income housing, and renewable energy production credits.

Can I use tax preparation software to complete the IRS Credit Limit Worksheet?

+Yes, tax preparation software, such as TurboTax or H&R Block, can be used to complete the IRS Credit Limit Worksheet. These software programs provide a step-by-step guide to calculating the allowable credit limit and can help ensure accuracy.

What is the difference between the tentative credit limit and the allowable credit limit?

+The tentative credit limit is the total amount of credits claimed multiplied by the applicable credit limit percentage. The allowable credit limit is the tentative credit limit minus any limitations or reductions.