Hair Stylist Tax Deductions Made Easy

Understanding Hair Stylist Tax Deductions

As a hair stylist, you’re entitled to claim various tax deductions to reduce your taxable income and lower your tax liability. Understanding what you can and can’t claim is essential to ensure you’re taking advantage of all the deductions available to you. In this article, we’ll break down the most common hair stylist tax deductions, providing you with a comprehensive guide to simplify your tax preparation.

Business Use of Your Home

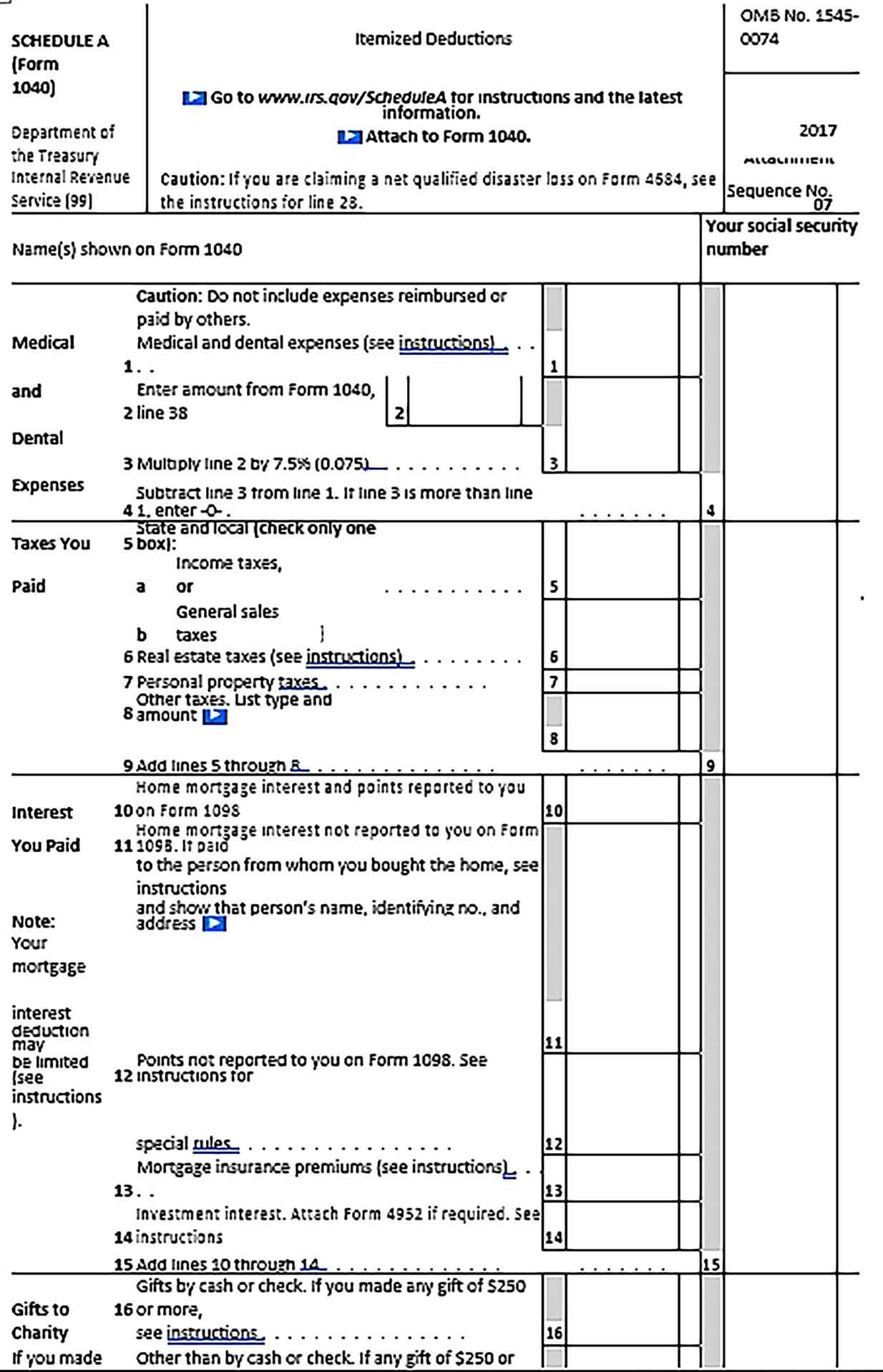

If you use a dedicated space in your home for business purposes, such as storing equipment, products, or conducting administrative tasks, you may be eligible to claim a home office deduction. This deduction allows you to claim a portion of your rent or mortgage interest, utilities, and other expenses related to the business use of your home.

Calculating Your Home Office Deduction:

You can use the Simplified Option for Home Office Deduction, which allows you to deduct 5 per square foot of home office space, up to a maximum of 1,500. Alternatively, you can calculate the actual expenses related to your home office and deduct that amount.

📝 Note: Keep accurate records of your home office expenses, including photos and measurements of your workspace, to support your deduction in case of an audit.

Business Use of Your Car

As a hair stylist, you may use your car to travel to client appointments, attend industry events, or purchase supplies. You can claim a deduction for the business use of your car using one of two methods:

- Standard Mileage Rate: Multiply the total business miles driven by the standard mileage rate (58 cents per mile for 2022).

- Actual Expenses: Calculate the actual expenses related to your car, including gas, maintenance, insurance, and registration.

Tracking Your Business Miles:

Keep a logbook or use a mobile app to track your business miles. You’ll need to record the date, destination, and purpose of each trip, as well as the starting and ending odometer readings.

Equipment and Supplies

As a hair stylist, you use various equipment and supplies to perform your job. You can claim a deduction for the following:

- Equipment: Scissors, clippers, dryers, and other equipment used for business purposes.

- Supplies: Hair products, color, and other consumable supplies.

- Furniture and Decor: Chairs, tables, and other furniture and decor used in your workspace.

Depreciating Equipment:

You can depreciate equipment over its useful life, which is typically 5-7 years for most equipment. Use the Modified Accelerated Cost Recovery System (MACRS) to calculate depreciation.

Continuing Education and Training

As a hair stylist, it’s essential to stay up-to-date with the latest techniques and trends. You can claim a deduction for continuing education and training expenses, including:

- Workshops and Classes: Tuition fees for workshops, classes, and online courses.

- Conferences and Trade Shows: Registration fees, travel, and accommodation expenses related to attending industry events.

- Certifications and Licenses: Fees related to obtaining certifications or licenses.

Insurance Premiums

As a hair stylist, you may need to purchase liability insurance to protect yourself and your business. You can claim a deduction for insurance premiums, including:

- Liability Insurance: Premiums paid for liability insurance to protect yourself and your business.

- Business Insurance: Premiums paid for business insurance, including property and equipment coverage.

Membership Fees and Subscriptions

As a hair stylist, you may be a member of professional associations or subscribe to industry publications. You can claim a deduction for:

- Membership Fees: Fees paid to professional associations, such as the National Association of Barber Boards of America.

- Subscriptions: Fees paid for industry publications, such as trade magazines or online subscriptions.

Meals and Entertainment

As a hair stylist, you may entertain clients or colleagues to build relationships and promote your business. You can claim a deduction for meals and entertainment expenses, including:

- Meals: Meals with clients or colleagues, limited to 50% of the total cost.

- Entertainment: Entertainment expenses, such as tickets to events or shows, limited to 50% of the total cost.

📝 Note: Keep accurate records of your meals and entertainment expenses, including receipts and records of the business purpose and attendees.

| Category | Allowable Deduction |

|---|---|

| Business Use of Home | $5 per square foot (up to $1,500) |

| Business Use of Car | 58 cents per mile (standard mileage rate) |

| Equipment and Supplies | 100% of cost (equipment) or cost of supplies |

| Continuing Education and Training | 100% of cost |

| Insurance Premiums | 100% of premiums paid |

| Membership Fees and Subscriptions | 100% of fees paid |

| Meals and Entertainment | 50% of total cost |

By understanding and claiming these common hair stylist tax deductions, you can reduce your taxable income and lower your tax liability. Remember to keep accurate records and consult with a tax professional if you’re unsure about any of the deductions or calculations.

Wrapping Up

As a hair stylist, it’s essential to stay organized and keep accurate records to ensure you’re taking advantage of all the tax deductions available to you. By following the guidelines outlined in this article, you’ll be well on your way to simplifying your tax preparation and reducing your tax liability.

What is the standard mileage rate for 2022?

+The standard mileage rate for 2022 is 58 cents per mile.

Can I deduct the cost of hair products as a business expense?

+Yes, you can deduct the cost of hair products as a business expense, but you must keep accurate records of the purchases and use them for business purposes only.

How do I calculate the business use of my car?

+You can calculate the business use of your car by multiplying the total business miles driven by the standard mileage rate (58 cents per mile for 2022) or by calculating the actual expenses related to your car, including gas, maintenance, insurance, and registration.

Related Terms:

- Hair Stylist Income Spreadsheet

- Salon expenses spreadsheet

- Salon Income and Expense sheet

- Free Salon bookkeeping Spreadsheet