5 Ways to Complete Genworth Rental Income Worksheet

Unlocking the Power of Rental Income: A Step-by-Step Guide to Completing the Genworth Rental Income Worksheet

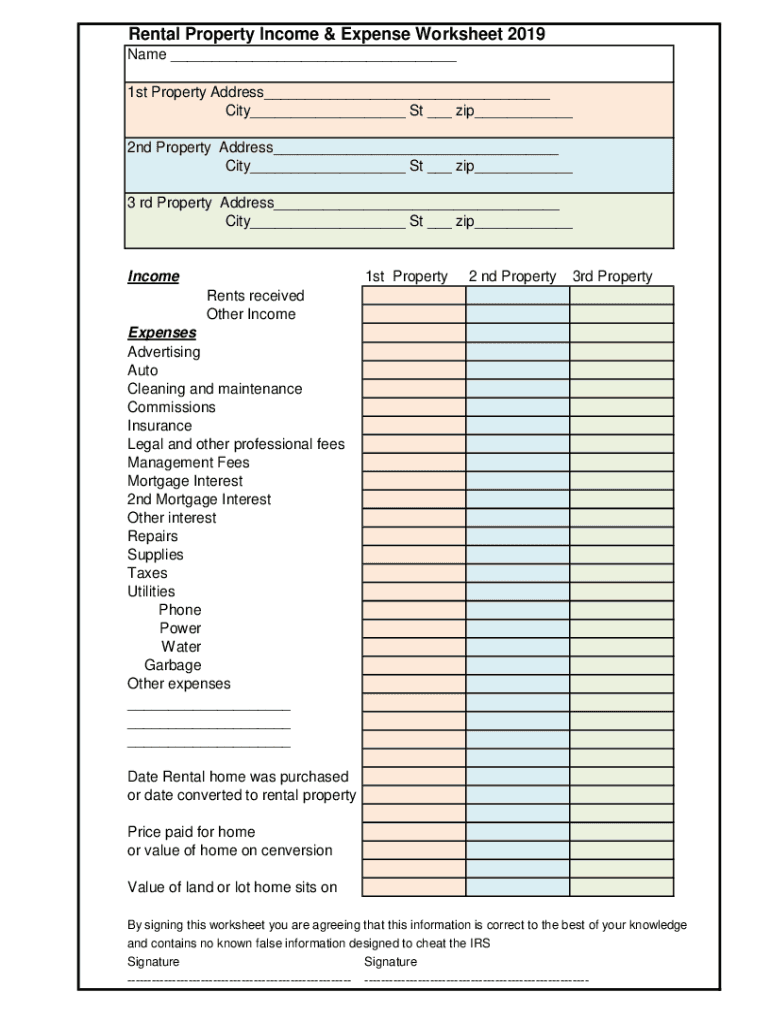

As a mortgage broker or lender, accurately assessing rental income is crucial when evaluating a borrower’s creditworthiness. The Genworth Rental Income Worksheet is a valuable tool designed to help you calculate rental income and ensure compliance with regulatory requirements. In this comprehensive guide, we will walk you through five ways to complete the Genworth Rental Income Worksheet, providing you with a clear understanding of the process and highlighting key considerations along the way.

Understanding the Genworth Rental Income Worksheet

Before diving into the completion process, it’s essential to understand the purpose and layout of the Genworth Rental Income Worksheet. The worksheet is designed to help lenders and mortgage brokers calculate a borrower’s rental income, taking into account various factors such as gross rental income, operating expenses, and tax deductions.

📝 Note: The Genworth Rental Income Worksheet is subject to change, and it's crucial to use the most up-to-date version when calculating rental income.

Method 1: Using the Gross Income Method

The Gross Income Method is a straightforward approach to calculating rental income. This method involves adding up all the gross rental income from the subject property and then deducting operating expenses.

Step 1: List all the gross rental income from the subject property, including any additional income sources such as laundry or vending machines.

Step 2: Calculate the total gross rental income by adding up all the individual income sources.

Step 3: Deduct operating expenses, such as property taxes, insurance, and maintenance costs, from the total gross rental income.

Step 4: Calculate the net rental income by subtracting the operating expenses from the total gross rental income.

| Gross Rental Income | Operating Expenses | Net Rental Income |

|---|---|---|

| $100,000 | $30,000 | $70,000 |

Method 2: Using the Modified Gross Income Method

The Modified Gross Income Method is similar to the Gross Income Method, but it takes into account additional income sources and deductions.

Step 1: List all the gross rental income from the subject property, including any additional income sources such as laundry or vending machines.

Step 2: Calculate the total gross rental income by adding up all the individual income sources.

Step 3: Deduct operating expenses, such as property taxes, insurance, and maintenance costs, from the total gross rental income.

Step 4: Add back any depreciation or amortization expenses that were deducted from the operating expenses.

Step 5: Calculate the net rental income by subtracting the operating expenses from the total gross rental income.

| Gross Rental Income | Operating Expenses | Depreciation/Amortization | Net Rental Income |

|---|---|---|---|

| $100,000 | $30,000 | $10,000 | $80,000 |

Method 3: Using the Net Operating Income Method

The Net Operating Income Method involves calculating the net operating income from the subject property.

Step 1: List all the gross rental income from the subject property.

Step 2: Calculate the total gross rental income by adding up all the individual income sources.

Step 3: Deduct operating expenses, such as property taxes, insurance, and maintenance costs, from the total gross rental income.

Step 4: Calculate the net operating income by subtracting the operating expenses from the total gross rental income.

| Gross Rental Income | Operating Expenses | Net Operating Income |

|---|---|---|

| $100,000 | $30,000 | $70,000 |

Method 4: Using the Tax Return Method

The Tax Return Method involves using the borrower’s tax return to calculate the rental income.

Step 1: Obtain the borrower’s tax return for the previous two years.

Step 2: Identify the rental income reported on the tax return.

Step 3: Calculate the average rental income over the two-year period.

Step 4: Use the average rental income as the net rental income.

| Tax Year | Rental Income |

|---|---|

| Year 1 | $80,000 |

| Year 2 | $90,000 |

| Average Rental Income | $85,000 |

Method 5: Using the Appraisal Report Method

The Appraisal Report Method involves using the appraisal report to calculate the rental income.

Step 1: Obtain the appraisal report for the subject property.

Step 2: Identify the gross rental income reported on the appraisal report.

Step 3: Deduct operating expenses, such as property taxes, insurance, and maintenance costs, from the gross rental income.

Step 4: Calculate the net rental income by subtracting the operating expenses from the gross rental income.

| Gross Rental Income | Operating Expenses | Net Rental Income |

|---|---|---|

| $100,000 | $30,000 | $70,000 |

In conclusion, accurately calculating rental income is crucial when evaluating a borrower’s creditworthiness. The Genworth Rental Income Worksheet provides a valuable tool to help lenders and mortgage brokers calculate rental income and ensure compliance with regulatory requirements. By following the five methods outlined in this guide, you can ensure that you are accurately calculating rental income and making informed lending decisions.

What is the purpose of the Genworth Rental Income Worksheet?

+The Genworth Rental Income Worksheet is designed to help lenders and mortgage brokers calculate a borrower’s rental income, taking into account various factors such as gross rental income, operating expenses, and tax deductions.

What are the five methods for completing the Genworth Rental Income Worksheet?

+The five methods are: (1) Gross Income Method, (2) Modified Gross Income Method, (3) Net Operating Income Method, (4) Tax Return Method, and (5) Appraisal Report Method.

What is the importance of accurately calculating rental income?

+Accurately calculating rental income is crucial when evaluating a borrower’s creditworthiness, as it helps lenders and mortgage brokers make informed lending decisions and ensures compliance with regulatory requirements.

Related Terms:

- Rental income Worksheet PDF

- Rental income Calculation Worksheet Excel

- Self-employed income worksheet

- self-employed income calculation worksheet excel

- Income Calculation Worksheet PDF

- Enact income calculator