5 Ways to Calculate Your Genworth Income

Understanding Genworth Income Calculation

Calculating your Genworth income is crucial for planning your financial future, especially if you’re relying on this income for retirement or other long-term goals. Genworth Financial is a leading insurance company that offers various financial products, including life insurance and annuities. Understanding how to calculate your Genworth income can help you make informed decisions about your financial planning. In this article, we’ll explore five ways to calculate your Genworth income.

Method 1: Using the Genworth Income Calculator Tool

The easiest way to calculate your Genworth income is by using the company’s official income calculator tool. This tool is available on the Genworth website and allows you to enter your policy details and other relevant information to get an estimate of your income.

- Visit the Genworth website and navigate to the income calculator tool.

- Enter your policy number, birth date, and other required information.

- Select the income option you prefer (e.g., monthly, quarterly, or annually).

- Click the “Calculate” button to get an estimate of your Genworth income.

📝 Note: You may need to register or log in to your Genworth account to access the income calculator tool.

Method 2: Reviewing Your Policy Documents

Another way to calculate your Genworth income is by reviewing your policy documents. Your policy documents should outline the terms and conditions of your income payments, including the payment amount, frequency, and duration.

- Gather your policy documents, including the policy schedule and any riders or amendments.

- Review the policy documents to understand the income payment terms, including the payment amount, frequency, and duration.

- Use a calculator to calculate your income based on the policy terms.

Method 3: Contacting Genworth Customer Service

If you’re unsure about how to calculate your Genworth income or need help understanding your policy terms, you can contact Genworth customer service for assistance.

- Call Genworth customer service at the phone number listed on their website or on your policy documents.

- Provide your policy number and other required information to the customer service representative.

- Ask the representative to explain your income payment terms and calculate your income for you.

Method 4: Using a Financial Calculator

You can also use a financial calculator to calculate your Genworth income. A financial calculator can help you calculate your income based on the policy terms and other relevant factors.

- Choose a financial calculator that can handle annuity or insurance calculations.

- Enter the policy terms, including the payment amount, frequency, and duration.

- Use the calculator to calculate your income based on the policy terms.

Method 5: Consulting a Financial Advisor

Finally, you can consult a financial advisor to help you calculate your Genworth income. A financial advisor can help you understand your policy terms and calculate your income based on your individual circumstances.

- Find a financial advisor who is familiar with Genworth products and income calculations.

- Provide the advisor with your policy documents and other relevant information.

- Ask the advisor to calculate your income and provide guidance on how to manage your income payments.

| Method | Description |

|---|---|

| Genworth Income Calculator Tool | Use the official Genworth income calculator tool to estimate your income. |

| Reviewing Policy Documents | Review your policy documents to understand the income payment terms. |

| Contacting Genworth Customer Service | Contact Genworth customer service for assistance with calculating your income. |

| Using a Financial Calculator | Use a financial calculator to calculate your income based on the policy terms. |

| Consulting a Financial Advisor | Consult a financial advisor to help you calculate your income and provide guidance on managing your income payments. |

In conclusion, calculating your Genworth income is a crucial step in planning your financial future. By using one or more of the methods outlined above, you can get an accurate estimate of your income and make informed decisions about your financial planning.

What is the Genworth income calculator tool?

+The Genworth income calculator tool is an online tool provided by Genworth that allows you to estimate your income based on your policy terms.

How do I contact Genworth customer service?

+You can contact Genworth customer service by calling the phone number listed on their website or on your policy documents.

What is the benefit of consulting a financial advisor?

+A financial advisor can help you understand your policy terms and calculate your income based on your individual circumstances, providing personalized guidance and advice.

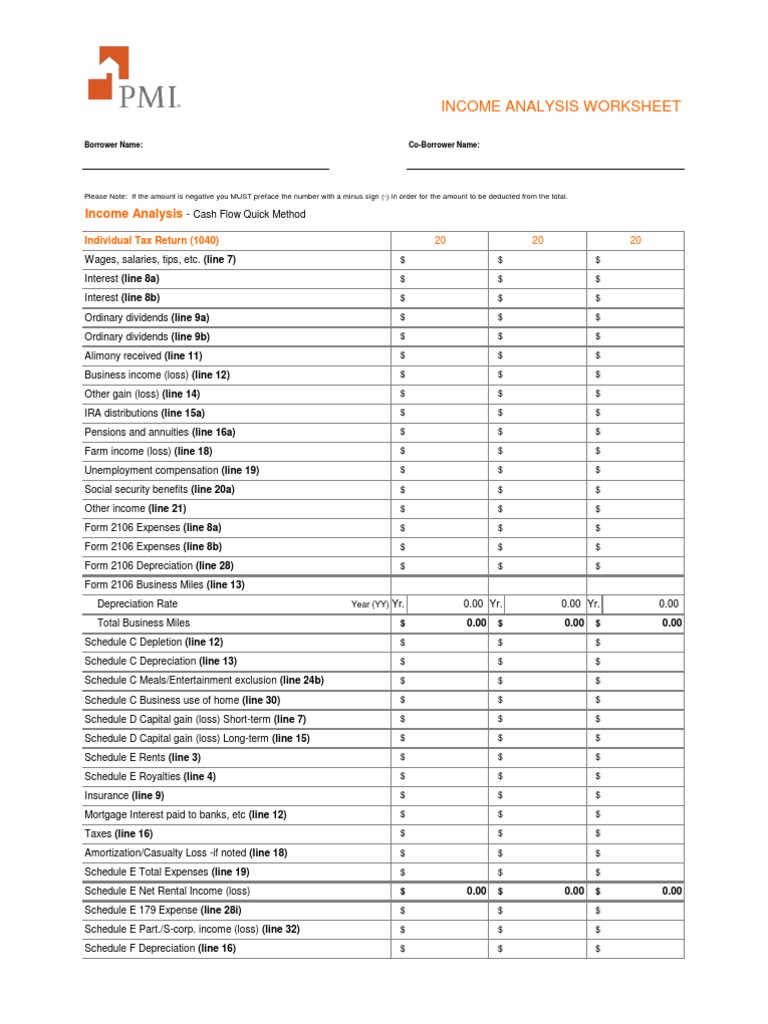

Related Terms:

- Income Calculation Worksheet PDF

- self-employed income calculation worksheet excel

- Schedule C income calculation worksheet

- 1120S income calculation worksheet

- self-employment income calculator for mortgage

- Rental income Worksheet