Form 982 Insolvency Worksheet

Understanding Form 982: The Insolvency Worksheet

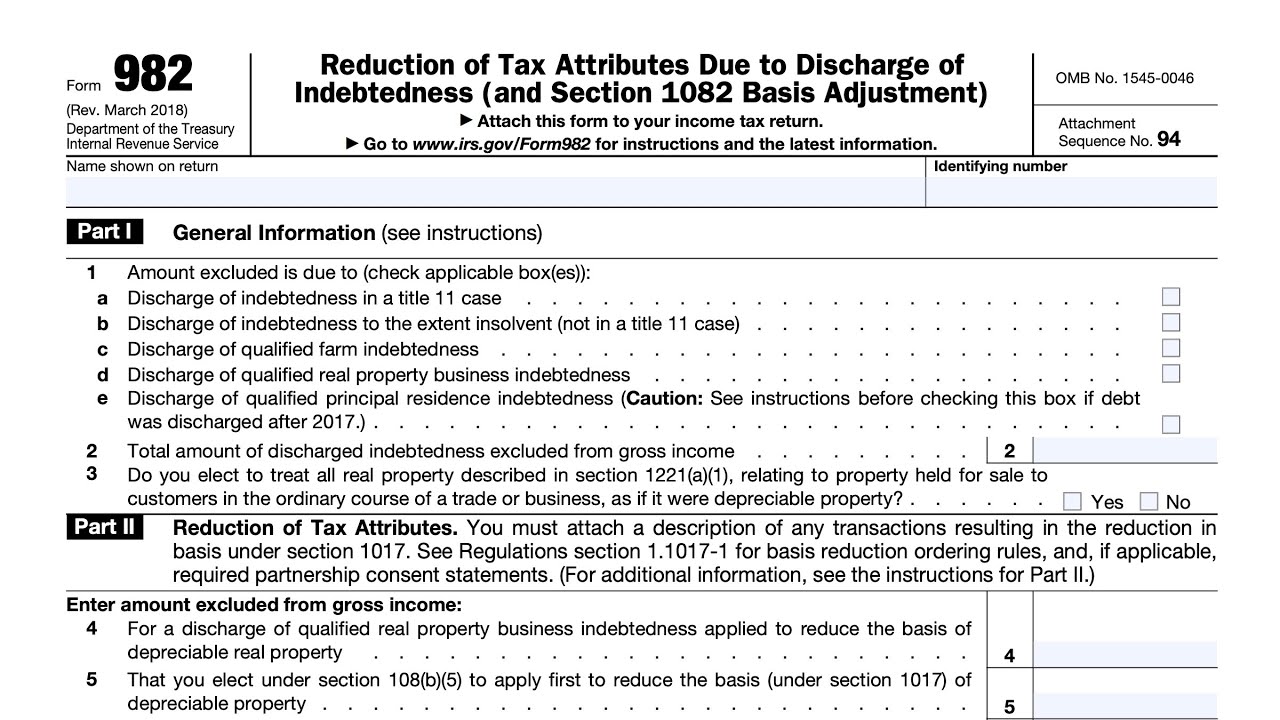

When dealing with debt cancellation and insolvency, it’s essential to understand the tax implications and how to report them to the Internal Revenue Service (IRS). Form 982, also known as the Reduction of Tax Attributes Due to Discharge of Indebtedness, is a crucial document in this process. In this article, we’ll delve into the insolvency worksheet and guide you through the steps to complete Form 982.

What is Form 982?

Form 982 is used to report the reduction of tax attributes due to the discharge of indebtedness. This form is typically filed when a taxpayer’s debt is cancelled or forgiven, and they need to report the resulting taxable income. However, if the taxpayer is insolvent, they may be able to exclude some or all of the cancelled debt from their taxable income.

What is Insolvency?

Insolvency occurs when a taxpayer’s total liabilities exceed their total assets. This can happen when a taxpayer is struggling to pay their debts, and their creditors agree to cancel or forgive part of the debt. To qualify for insolvency, the taxpayer must meet the following conditions:

- The debt must be cancelled or forgiven

- The taxpayer must be insolvent immediately before the cancellation

- The amount of debt cancelled must exceed the amount of the taxpayer’s assets

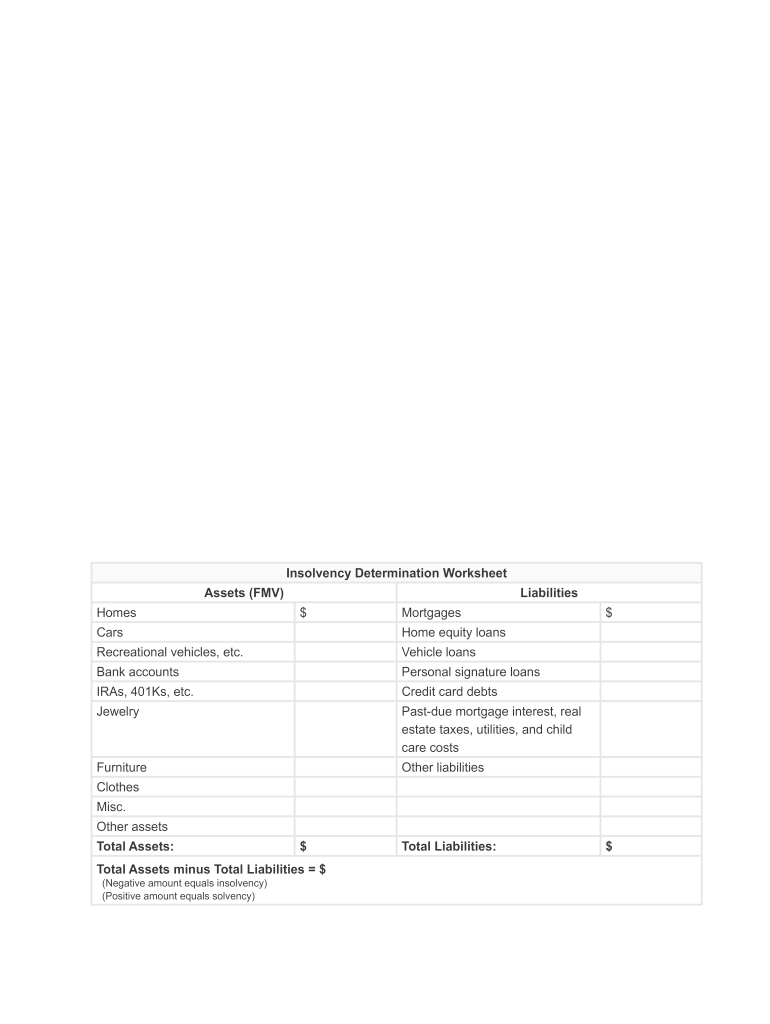

The Insolvency Worksheet

To determine the amount of debt that can be excluded from taxable income, taxpayers must complete the insolvency worksheet. This worksheet is used to calculate the amount of debt that can be excluded from income due to insolvency.

Insolvency Worksheet

| Assets | Liabilities |

|---|---|

| Cash and bank accounts | Credit card debt |

| Investments | Loans |

| Retirement accounts | Mortgages |

| Other assets | Other liabilities |

| Total Assets | Total Liabilities |

Insolvency Calculation

- List all assets and their corresponding values

- List all liabilities and their corresponding values

- Calculate the total assets and total liabilities

- Subtract the total assets from the total liabilities to determine the amount of insolvency

Completing Form 982

Once the insolvency worksheet is complete, taxpayers can use the results to complete Form 982.

Step 1: Identify the Type of Debt

- Check the box that corresponds to the type of debt cancelled (e.g., credit card debt, loan, mortgage)

Step 2: Calculate the Amount of Debt Cancelled

- Enter the total amount of debt cancelled

- Enter the amount of debt cancelled that is excluded from income due to insolvency (from the insolvency worksheet)

Step 3: Calculate the Reduction of Tax Attributes

- Calculate the reduction of tax attributes due to the discharge of indebtedness

- Enter the amount of reduction on Line 6 of Form 982

Important Notes

📝 Note: Taxpayers should keep accurate records of their assets, liabilities, and debt cancellation. This information will be necessary to complete Form 982 and the insolvency worksheet.

📝 Note: Taxpayers should consult with a tax professional or the IRS to ensure they are meeting the requirements for insolvency and completing Form 982 correctly.

Conclusion

Form 982 and the insolvency worksheet are essential tools for taxpayers dealing with debt cancellation and insolvency. By understanding how to complete these forms, taxpayers can ensure they are reporting their taxable income accurately and taking advantage of the tax benefits available to them.

What is the purpose of Form 982?

+

Form 982 is used to report the reduction of tax attributes due to the discharge of indebtedness. It is typically filed when a taxpayer’s debt is cancelled or forgiven, and they need to report the resulting taxable income.

How do I determine if I am insolvent?

+

To determine if you are insolvent, you must calculate your total assets and total liabilities. If your total liabilities exceed your total assets, you are considered insolvent.

What is the insolvency worksheet used for?

+

The insolvency worksheet is used to calculate the amount of debt that can be excluded from taxable income due to insolvency.