FHA Income Calculation Worksheet Made Easy

FHA Income Calculation Worksheet Made Easy

Calculating income for an FHA loan can be a complex process, but with the right tools and guidance, it can be made much easier. In this article, we will break down the FHA income calculation worksheet and provide a step-by-step guide on how to use it.

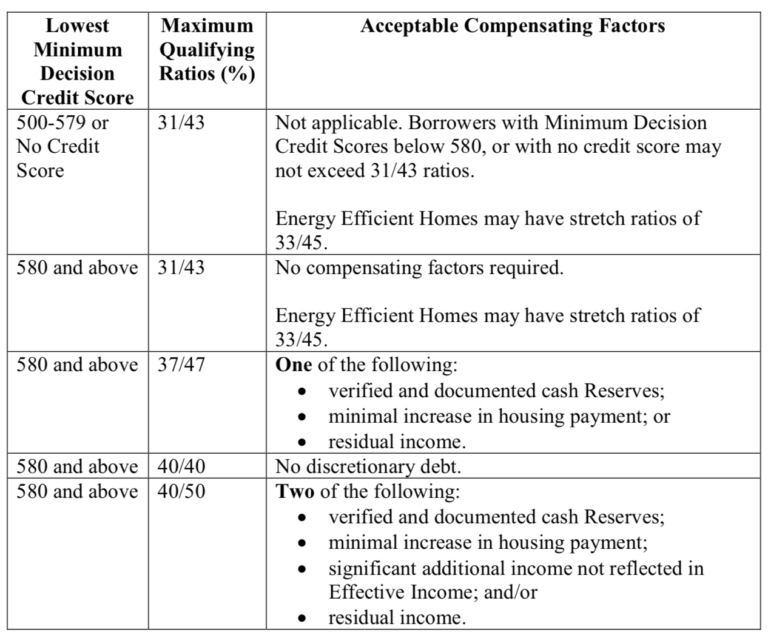

Understanding FHA Income Requirements

Before we dive into the worksheet, it’s essential to understand the FHA’s income requirements. The FHA has specific guidelines for calculating income, which can vary depending on the borrower’s employment status, income type, and other factors.

The FHA considers two types of income:

- Effective Income: This is the borrower’s gross income from all sources, minus any deductions and exclusions.

- Qualifying Income: This is the income used to qualify the borrower for the loan.

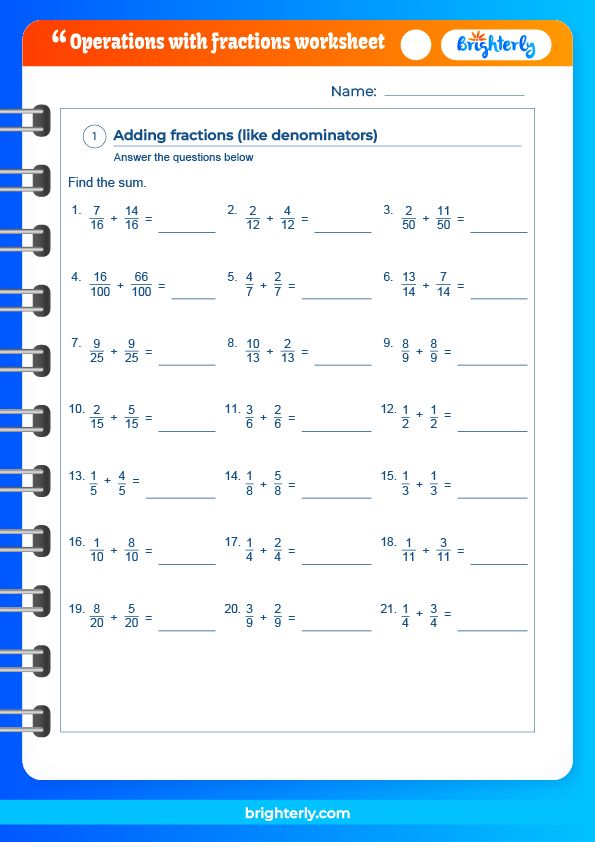

FHA Income Calculation Worksheet

The FHA income calculation worksheet is a standardized form used to calculate a borrower’s income. The worksheet is divided into several sections, each with its own set of calculations.

Here is a breakdown of the worksheet:

| Section | Description |

|---|---|

| A. Borrower’s Gross Income | List all sources of income, including employment, self-employment, and other income. |

| B. Income Deductions | List all deductions, including taxes, insurance, and other expenses. |

| C. Income Exclusions | List all exclusions, including income from non-borrowing spouses and dependents. |

| D. Effective Income | Calculate the borrower’s effective income by subtracting deductions and exclusions from gross income. |

| E. Qualifying Income | Calculate the borrower’s qualifying income, which may be adjusted for income from non-borrowing spouses and dependents. |

Step-by-Step Guide to Completing the Worksheet

Now that we have an overview of the worksheet, let’s go through a step-by-step guide on how to complete it.

Step 1: List Borrower’s Gross Income

List all sources of income, including:

- Employment income

- Self-employment income

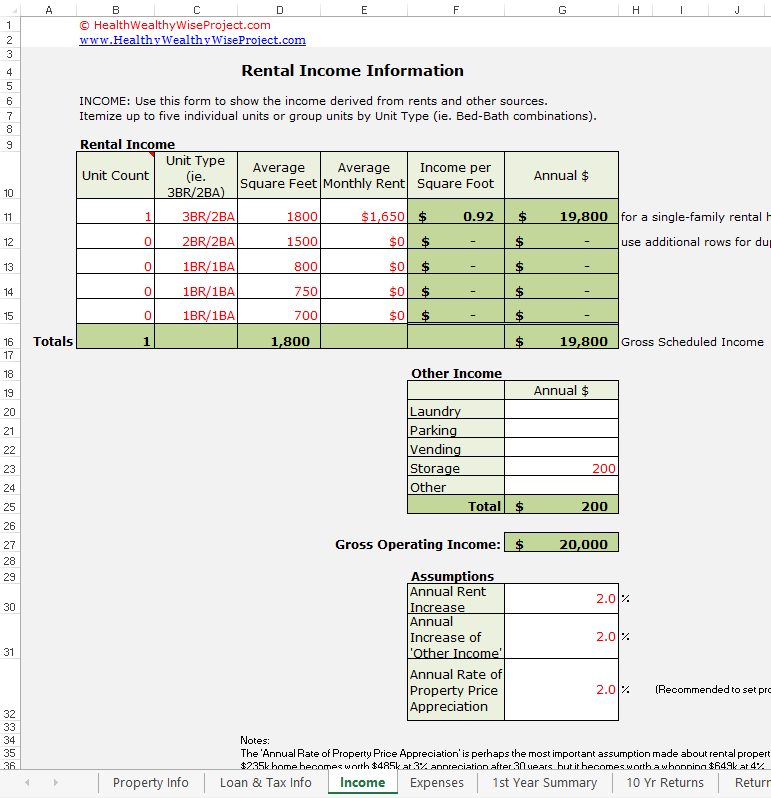

- Rental income

- Investment income

- Other income (e.g., alimony, child support)

Step 2: Calculate Income Deductions

Calculate all deductions, including:

- Federal income taxes

- State income taxes

- Insurance premiums (e.g., health, life, disability)

- Other expenses (e.g., union dues, subscriptions)

Step 3: Calculate Income Exclusions

Calculate all exclusions, including:

- Income from non-borrowing spouses and dependents

- Income from sources that are not subject to taxation (e.g., gifts, inheritances)

Step 4: Calculate Effective Income

Calculate the borrower’s effective income by subtracting deductions and exclusions from gross income.

Step 5: Calculate Qualifying Income

Calculate the borrower’s qualifying income, which may be adjusted for income from non-borrowing spouses and dependents.

📝 Note: The FHA has specific guidelines for calculating income from non-borrowing spouses and dependents. Be sure to review the FHA handbook for specific guidance.

Common Mistakes to Avoid

When completing the FHA income calculation worksheet, there are several common mistakes to avoid:

- Overstating income: Make sure to accurately report income and avoid overstating it.

- Failing to account for deductions: Make sure to account for all deductions, including taxes and insurance premiums.

- Failing to account for exclusions: Make sure to account for all exclusions, including income from non-borrowing spouses and dependents.

Conclusion

Calculating income for an FHA loan can be a complex process, but with the right tools and guidance, it can be made much easier. By following the steps outlined in this article and avoiding common mistakes, you can ensure that you accurately complete the FHA income calculation worksheet.

What is the FHA income calculation worksheet?

+The FHA income calculation worksheet is a standardized form used to calculate a borrower’s income for an FHA loan.

What is effective income?

+Effective income is the borrower’s gross income from all sources, minus any deductions and exclusions.

What is qualifying income?

+Qualifying income is the income used to qualify the borrower for the loan.

Related Terms:

- Income calculation worksheet Excel

- self-employed income calculation worksheet excel

- Income Calculation Worksheet PDF

- FHA Schedule C Income Worksheet

- FHA income calculation guidelines

- Schedule C income calculation worksheet