5 Tips for Credit Limit Worksheet a 8812

Understanding the Credit Limit Worksheet (Form 8812)

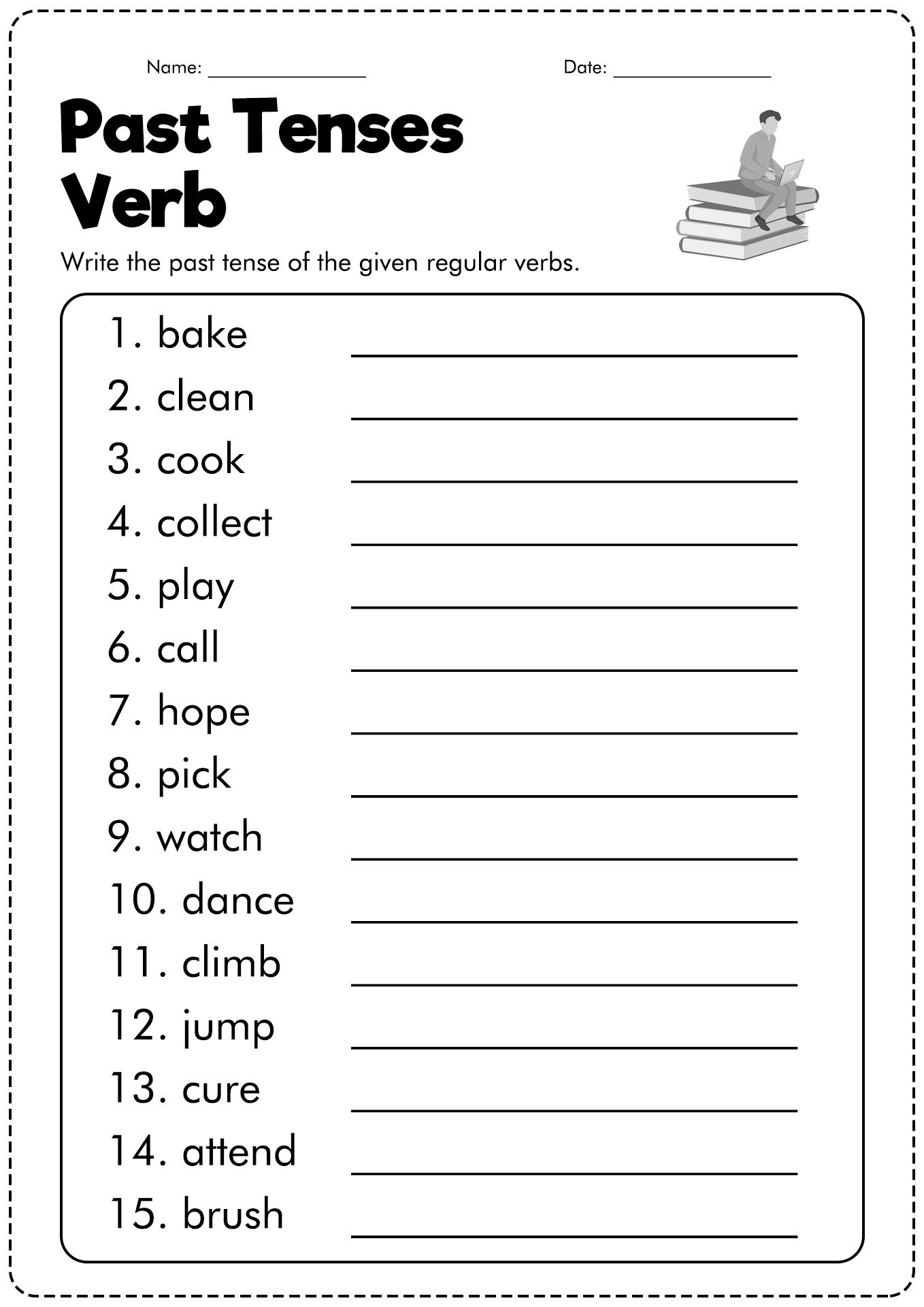

The Credit Limit Worksheet, also known as Form 8812, is a crucial tool used by taxpayers to calculate the Child Tax Credit (CTC) and the Additional Child Tax Credit (ACTC). This worksheet is particularly useful for families with qualifying children, as it helps determine the maximum credit amount they are eligible for. In this article, we will explore five essential tips to help you accurately complete the Credit Limit Worksheet.

Tip 1: Determine Your Qualifying Children

Before starting the Credit Limit Worksheet, it’s essential to identify the qualifying children in your household. A qualifying child must meet the following conditions:

- Be under the age of 17

- Be your son, daughter, stepchild, foster child, brother, sister, or a descendant of any of them (e.g., grandchild, niece, or nephew)

- Not have filed a joint return for the tax year (unless it’s only to claim a refund)

- Be a U.S. citizen, national, or resident

- Have a valid Social Security number

Make sure to list all qualifying children on Line 1 of the worksheet.

Tip 2: Calculate Your Modified Adjusted Gross Income (MAGI)

Your MAGI is a critical factor in determining your credit limit. To calculate your MAGI, you’ll need to follow these steps:

- Start with your Adjusted Gross Income (AGI) from Form 1040

- Add back any deductions for:

- Student loan interest

- Tuition and fees

- Foreign earned income exclusion

- Housing exclusion

- Adoption benefits

- Subtract any income from:

- Social Security benefits

- Dividends and capital gains

Enter your calculated MAGI on Line 2 of the worksheet.

Tip 3: Apply the Credit Limit Phaseout

The credit limit phaseout is a crucial step in determining your eligible credit amount. The phaseout thresholds are as follows:

- Single filers: $75,000

- Joint filers: $110,000

- Head of Household: $55,000

If your MAGI exceeds the phaseout threshold, you’ll need to calculate the reduction in your credit limit. Multiply the excess amount by 5% (0.05) and subtract the result from the maximum credit amount ($2,000 per child).

For example, if your MAGI is $120,000 (joint filers) and you have two qualifying children, the calculation would be:

- Excess amount: 120,000 - 110,000 = $10,000

- Reduction: 10,000 x 0.05 = 500

- Credit limit: 4,000 (2 x 2,000) - 500 = 3,500

Enter the reduced credit limit on Line 5 of the worksheet.

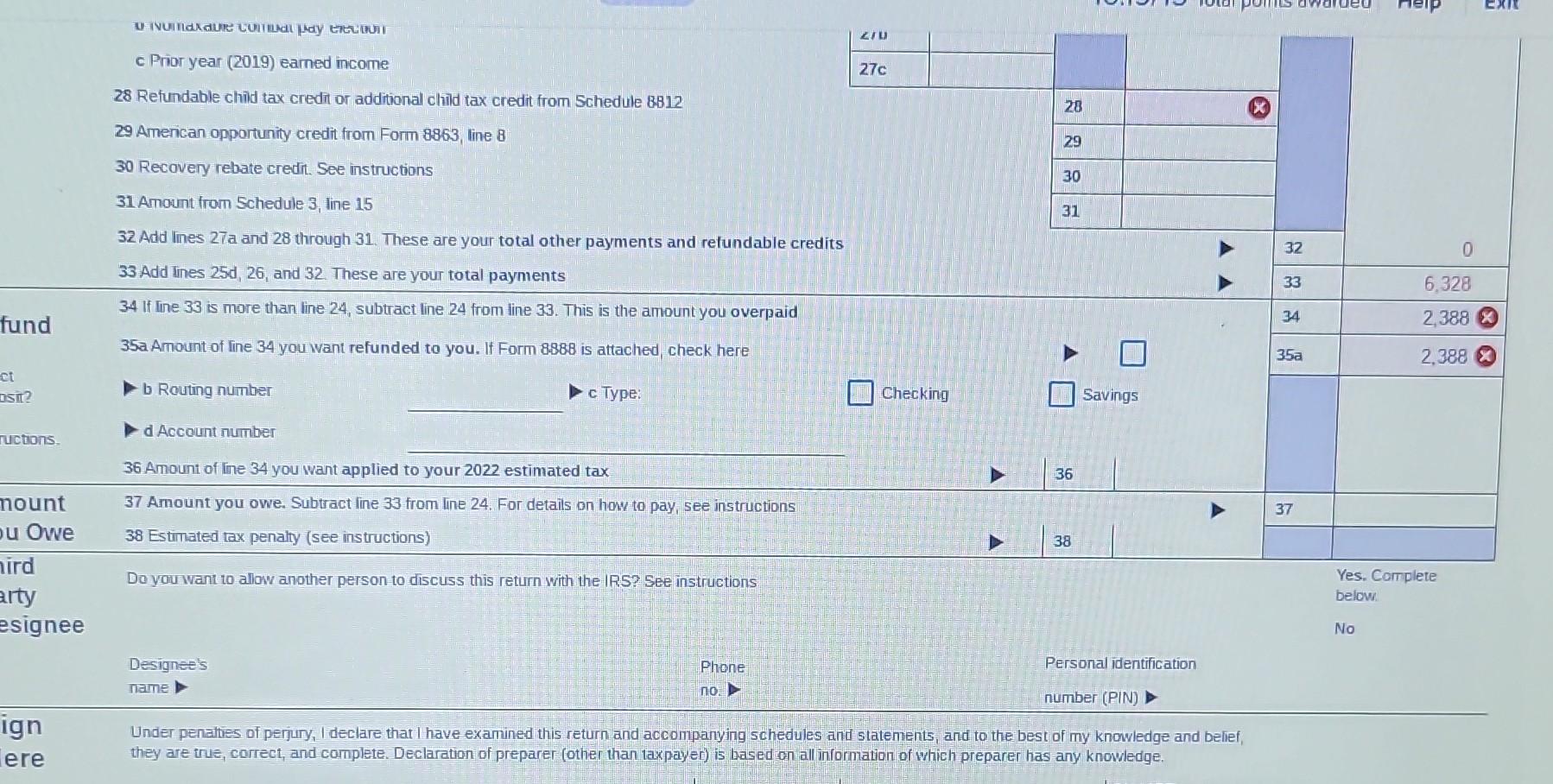

Tip 4: Calculate the Additional Child Tax Credit (ACTC)

The ACTC is a refundable credit that can provide additional benefits to eligible families. To calculate the ACTC, follow these steps:

- Enter the total credit amount from Line 5 on Line 6

- Multiply the credit amount by 15% (0.15)

- Subtract the result from the total credit amount

For example, if your credit limit is $3,500, the calculation would be:

- ACTC: 3,500 x 0.15 = 525

- Total credit: 3,500 - 525 = $2,975

Enter the ACTC on Line 7 of the worksheet.

Tip 5: Review and Verify Your Calculations

After completing the Credit Limit Worksheet, review your calculations carefully to ensure accuracy. Verify that you have:

- Listed all qualifying children

- Calculated your MAGI correctly

- Applied the credit limit phaseout accurately

- Calculated the ACTC correctly

If you’re unsure or have questions, consider consulting a tax professional or using tax preparation software to help guide you through the process.

📝 Note: The Credit Limit Worksheet is subject to change, so it's essential to check the IRS website for the most up-to-date information and instructions.

In summary, accurately completing the Credit Limit Worksheet requires attention to detail and a thorough understanding of the calculation steps. By following these five tips, you’ll be better equipped to navigate the worksheet and ensure you receive the maximum credit amount you’re eligible for.

What is the maximum credit amount for the Child Tax Credit?

+

The maximum credit amount for the Child Tax Credit is $2,000 per qualifying child.

Do I need to complete the Credit Limit Worksheet if I only have one qualifying child?

+

Yes, you’ll still need to complete the Credit Limit Worksheet to determine your credit limit, even if you only have one qualifying child.

Can I claim the Additional Child Tax Credit (ACTC) if I don’t have any qualifying children?

+

No, the ACTC is only available to families with qualifying children.

Related Terms:

- Credit Limit Worksheet a PDF

- Credit Limit Worksheet 8863

- Form 8812 instructions

- Earned Income Worksheet

- Schedule 8812 calculator

- Credit Limit Worksheet A 2022