Compound Interest Worksheet Answers Made Easy

Understanding Compound Interest: A Comprehensive Guide

Compound interest is a powerful financial concept that can help your savings grow exponentially over time. It’s a type of interest that is calculated on both the principal amount and any accrued interest, resulting in a snowball effect that can be quite impressive. In this article, we’ll delve into the world of compound interest, exploring its benefits, formulas, and examples. By the end of this guide, you’ll be equipped with the knowledge to tackle compound interest worksheets with ease.

What is Compound Interest?

Compound interest is the interest earned on both the principal amount and any accrued interest. It’s a type of interest that is calculated on a regular basis, such as monthly or annually, and is then added to the principal amount. This process creates a cycle where the interest earns interest, resulting in exponential growth.

Benefits of Compound Interest

The benefits of compound interest are numerous. Some of the most significant advantages include:

- Exponential growth: Compound interest can help your savings grow exponentially over time, resulting in a substantial increase in your principal amount.

- Passive income: Compound interest can generate passive income, allowing you to earn money without actively working for it.

- Long-term wealth creation: Compound interest is a powerful tool for long-term wealth creation, making it an ideal strategy for retirement planning or saving for a big purchase.

Compound Interest Formula

The compound interest formula is a straightforward equation that calculates the future value of an investment based on the principal amount, interest rate, and time. The formula is as follows:

A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment

- P = the principal amount

- r = the annual interest rate

- n = the number of times interest is compounded per year

- t = the number of years the money is invested for

Example of Compound Interest

Let’s say you invest $1,000 in a savings account with an annual interest rate of 5%. The interest is compounded annually, and you want to know how much your investment will be worth after 10 years.

Using the compound interest formula, we get:

A = 1000 (1 + 0.05/1)^(1*10) A = 1000 (1 + 0.05)^10 A = 1000 (1.05)^10 A = 1000 x 1.62889 A = 1628.89

As you can see, your investment of 1,000 has grown to 1,628.89 after 10 years, earning a total interest of $628.89.

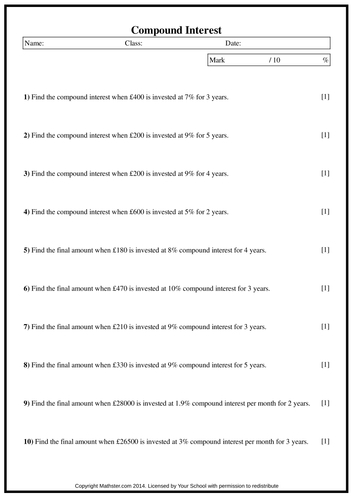

Compound Interest Worksheet Answers

Now that we’ve covered the basics of compound interest, let’s move on to some worksheet answers.

Problem 1

- Principal amount: $5,000

- Annual interest rate: 4%

- Compounded monthly

- Time: 5 years

A = 5000 (1 + 0.04/12)^(12*5) A = 5000 (1 + 0.003333)^60 A = 5000 (1.003333)^60 A = 5000 x 1.21665 A = 6083.25

Problem 2

- Principal amount: $10,000

- Annual interest rate: 6%

- Compounded quarterly

- Time: 10 years

A = 10000 (1 + 0.06/4)^(4*10) A = 10000 (1 + 0.015)^40 A = 10000 (1.015)^40 A = 10000 x 1.81402 A = 18140.20

Problem 3

- Principal amount: $2,000

- Annual interest rate: 3%

- Compounded annually

- Time: 7 years

A = 2000 (1 + 0.03/1)^(1*7) A = 2000 (1 + 0.03)^7 A = 2000 (1.03)^7 A = 2000 x 1.22597 A = 2451.94

📝 Note: The above problems are examples of compound interest calculations. You can use the formula to solve different problems with varying principal amounts, interest rates, and time periods.

Tips for Solving Compound Interest Problems

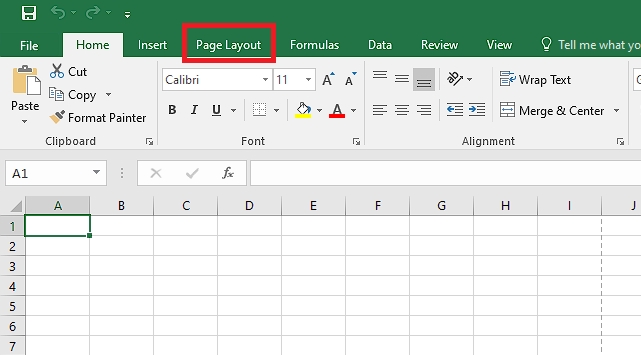

- Use the formula: The compound interest formula is a powerful tool for calculating the future value of an investment. Make sure to use it correctly to get accurate results.

- Break down the problem: Break down the problem into smaller parts, and identify the principal amount, interest rate, and time period.

- Use a calculator: Use a calculator to simplify the calculations and avoid errors.

Conclusion

Compound interest is a powerful financial concept that can help your savings grow exponentially over time. By understanding the benefits, formula, and examples of compound interest, you can tackle compound interest worksheets with ease. Remember to use the formula correctly, break down the problem, and use a calculator to simplify the calculations. With practice and patience, you’ll become a pro at solving compound interest problems in no time.

What is compound interest?

+Compound interest is the interest earned on both the principal amount and any accrued interest.

How is compound interest calculated?

+Compound interest is calculated using the formula A = P (1 + r/n)^(nt), where A is the future value, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

What are the benefits of compound interest?

+The benefits of compound interest include exponential growth, passive income, and long-term wealth creation.