Maximizing Tax Savings with Capital Loss Carryover Worksheet

Understanding Capital Loss Carryover

As an investor, you’re likely familiar with the concept of capital gains and losses. When you sell an investment, such as a stock or a bond, you may realize a gain or a loss. If you sell an investment for more than you paid for it, you have a capital gain. On the other hand, if you sell an investment for less than you paid for it, you have a capital loss.

Capital losses can be used to offset capital gains, which can help reduce your tax liability. However, if your capital losses exceed your capital gains, you may be able to carry over the excess loss to future tax years. This is known as a capital loss carryover.

How to Calculate Capital Loss Carryover

To calculate your capital loss carryover, you’ll need to follow these steps:

- Calculate your net capital loss: Start by calculating your net capital loss for the tax year. This is the total of all your capital losses minus any capital gains.

- Determine the carryover amount: If your net capital loss exceeds the amount you can deduct on your tax return, you may be able to carry over the excess loss to future tax years.

- Complete Form 8949: You’ll need to complete Form 8949, Sales and Other Dispositions of Capital Assets, to report your capital gains and losses.

- Calculate the carryover: Use the Capital Loss Carryover Worksheet (more on this below) to calculate the amount of the carryover.

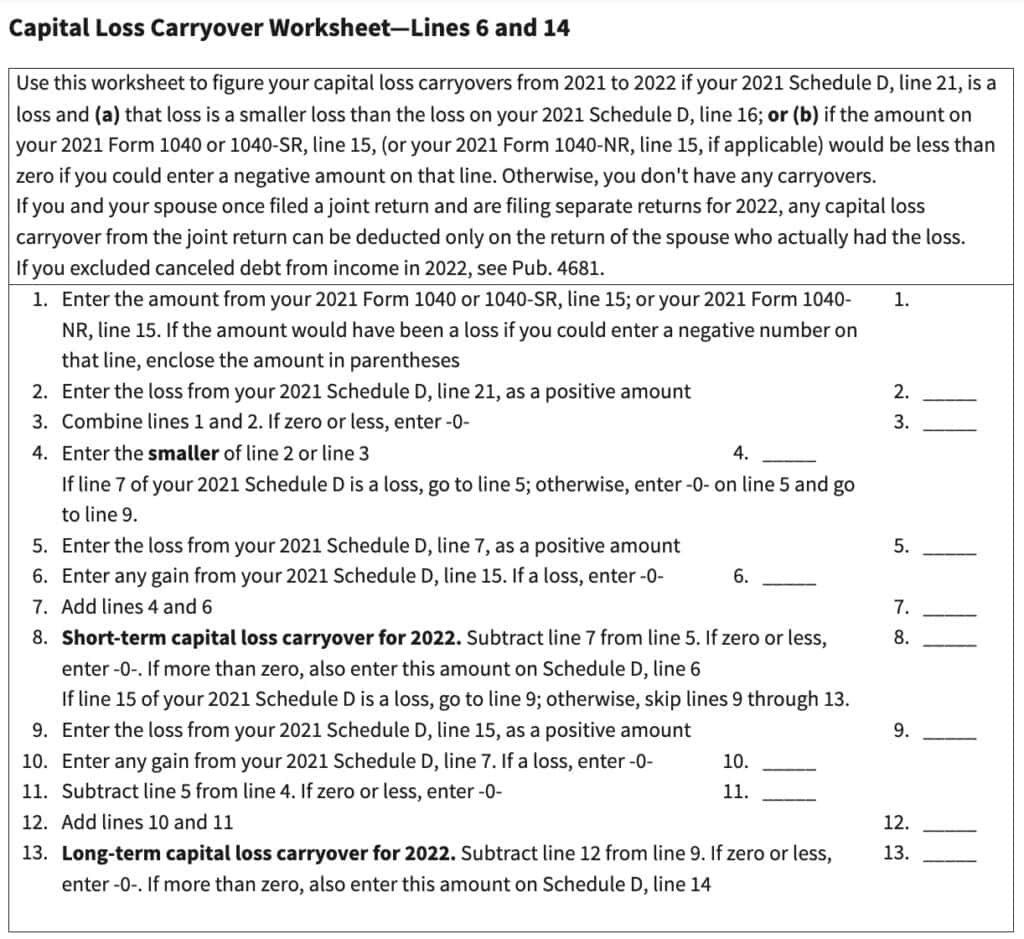

Capital Loss Carryover Worksheet

The Capital Loss Carryover Worksheet is a useful tool to help you calculate the amount of your capital loss carryover. Here’s a sample worksheet:

| Year | Net Capital Loss | Capital Loss Carryover |

|---|---|---|

| 2022 | $10,000 | $3,000 (carryover from 2021) |

| 2023 | $5,000 | $2,000 (carryover from 2022) |

| 2024 | $8,000 | $1,000 (carryover from 2023) |

Using this worksheet, you can see that the net capital loss for 2022 is 10,000, and the capital loss carryover from 2021 is 3,000. The total capital loss carryover for 2022 is $13,000.

📝 Note: You can only carry over capital losses to future tax years if you have a net capital loss for the year.

How to Use the Capital Loss Carryover Worksheet

To use the Capital Loss Carryover Worksheet, follow these steps:

- Enter the year: Enter the tax year for which you’re calculating the capital loss carryover.

- Enter the net capital loss: Enter the net capital loss for the year.

- Enter the capital loss carryover: Enter the capital loss carryover from the previous year.

- Calculate the total capital loss carryover: Add the net capital loss and the capital loss carryover to get the total capital loss carryover.

Maximizing Tax Savings with Capital Loss Carryover

Now that you understand how to calculate capital loss carryover, let’s talk about how to maximize tax savings using this strategy.

- Harvest losses: Consider selling investments that have declined in value to realize losses. This can help offset gains from other investments.

- Use the carryover: If you have a capital loss carryover, use it to offset gains in future tax years.

- Plan ahead: Consider the tax implications of buying and selling investments. Try to balance gains and losses to minimize tax liability.

By using the Capital Loss Carryover Worksheet and following these strategies, you can maximize tax savings and reduce your tax liability.

The key to maximizing tax savings with capital loss carryover is to plan ahead and be strategic about buying and selling investments. By understanding how to calculate capital loss carryover and using the worksheet, you can make informed decisions about your investments and reduce your tax liability.