California Itemized Deductions Worksheet Simplified

Understanding California Itemized Deductions: A Simplified Guide

When it comes to filing your taxes in California, understanding itemized deductions can help you save money on your tax bill. However, navigating the complex world of tax deductions can be overwhelming, especially for those who are new to itemizing. In this guide, we will break down the California itemized deductions worksheet and provide a simplified explanation of the process.

What are Itemized Deductions?

Itemized deductions are expenses that you can claim on your tax return to reduce your taxable income. In California, you can choose to itemize your deductions instead of taking the standard deduction. Itemized deductions can include expenses such as mortgage interest, charitable donations, and medical expenses.

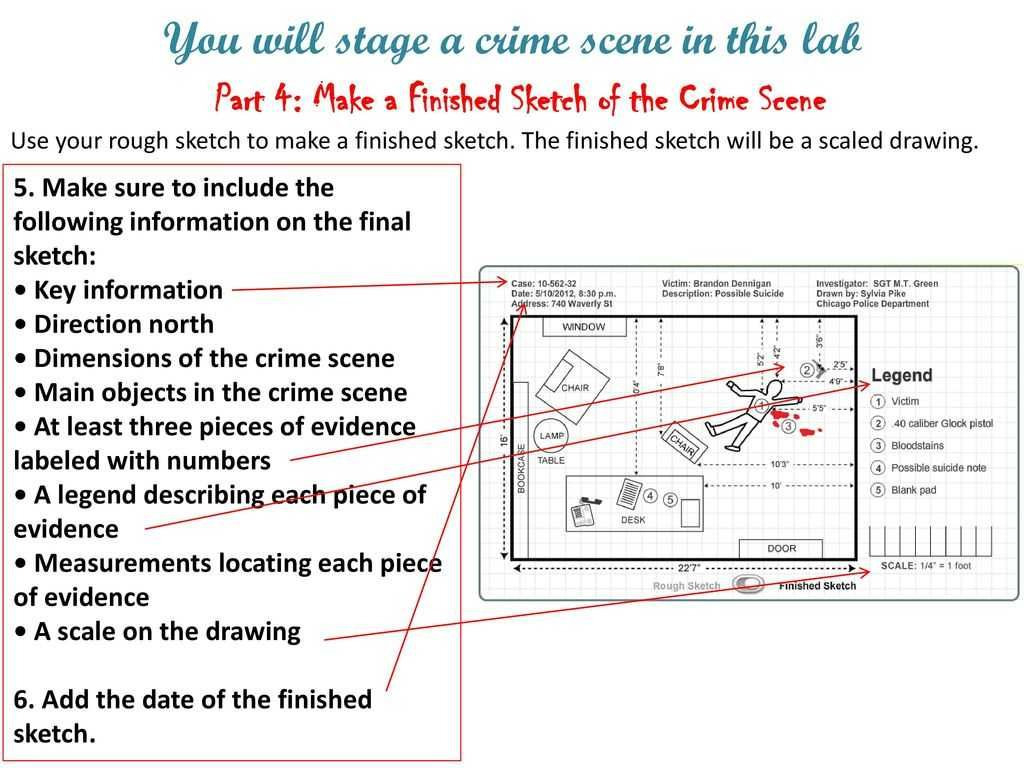

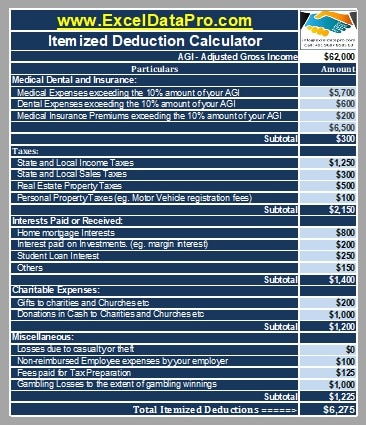

The California Itemized Deductions Worksheet

The California itemized deductions worksheet is a form used to calculate your total itemized deductions. The worksheet is divided into several sections, each corresponding to a different type of deduction. Here is a simplified breakdown of the worksheet:

Section 1: Medical Expenses

- Medical expenses: List your medical expenses, including doctor visits, hospital stays, and prescription medications.

- Total medical expenses: Add up your medical expenses and enter the total.

Section 2: Mortgage Interest and Property Taxes

- Mortgage interest: Enter the amount of mortgage interest you paid on your primary residence and any secondary homes.

- Property taxes: Enter the amount of property taxes you paid on your primary residence and any secondary homes.

- Total mortgage interest and property taxes: Add up your mortgage interest and property taxes and enter the total.

Section 3: Charitable Donations

- Cash donations: Enter the amount of cash donations you made to qualified charitable organizations.

- Non-cash donations: Enter the amount of non-cash donations, such as donations of goods or services.

- Total charitable donations: Add up your cash and non-cash donations and enter the total.

Section 4: Miscellaneous Deductions

- Unreimbursed employee expenses: Enter the amount of unreimbursed employee expenses, such as business use of your car.

- Investment expenses: Enter the amount of investment expenses, such as investment management fees.

- Total miscellaneous deductions: Add up your unreimbursed employee expenses and investment expenses and enter the total.

Section 5: Total Itemized Deductions

- Total itemized deductions: Add up your medical expenses, mortgage interest and property taxes, charitable donations, and miscellaneous deductions to get your total itemized deductions.

📝 Note: This is a simplified breakdown of the California itemized deductions worksheet. You should consult the official worksheet and instructions for specific details and requirements.

How to Fill Out the Worksheet

To fill out the worksheet, follow these steps:

- Gather all of your receipts and documentation for your itemized deductions.

- Complete each section of the worksheet, starting with medical expenses and working your way down.

- Add up your deductions in each section and enter the totals.

- Add up your total itemized deductions in Section 5.

- Compare your total itemized deductions to the standard deduction. If your total itemized deductions are greater than the standard deduction, you may benefit from itemizing.

Important Notes

- Keep accurate records: Make sure to keep accurate records of your itemized deductions, including receipts and documentation.

- Consult the instructions: Consult the official instructions and worksheet for specific details and requirements.

- Seek professional help: If you are unsure about how to fill out the worksheet or need help with your taxes, consider seeking the help of a tax professional.

Conclusion

Itemizing your deductions can be a great way to save money on your tax bill, but it can be overwhelming to navigate the complex world of tax deductions. By following this simplified guide and using the California itemized deductions worksheet, you can make the process easier and ensure that you are taking advantage of all the deductions you are eligible for.

What is the difference between the standard deduction and itemized deductions?

+The standard deduction is a fixed amount that you can deduct from your taxable income without itemizing. Itemized deductions, on the other hand, are expenses that you can claim on your tax return to reduce your taxable income. If your total itemized deductions are greater than the standard deduction, you may benefit from itemizing.

What expenses can I include in my itemized deductions?

+You can include expenses such as medical expenses, mortgage interest, property taxes, charitable donations, and miscellaneous deductions, such as unreimbursed employee expenses and investment expenses.

Do I need to keep receipts for my itemized deductions?

+Yes, it is recommended that you keep accurate records of your itemized deductions, including receipts and documentation. This will help you to accurately complete your tax return and to support your deductions in case of an audit.