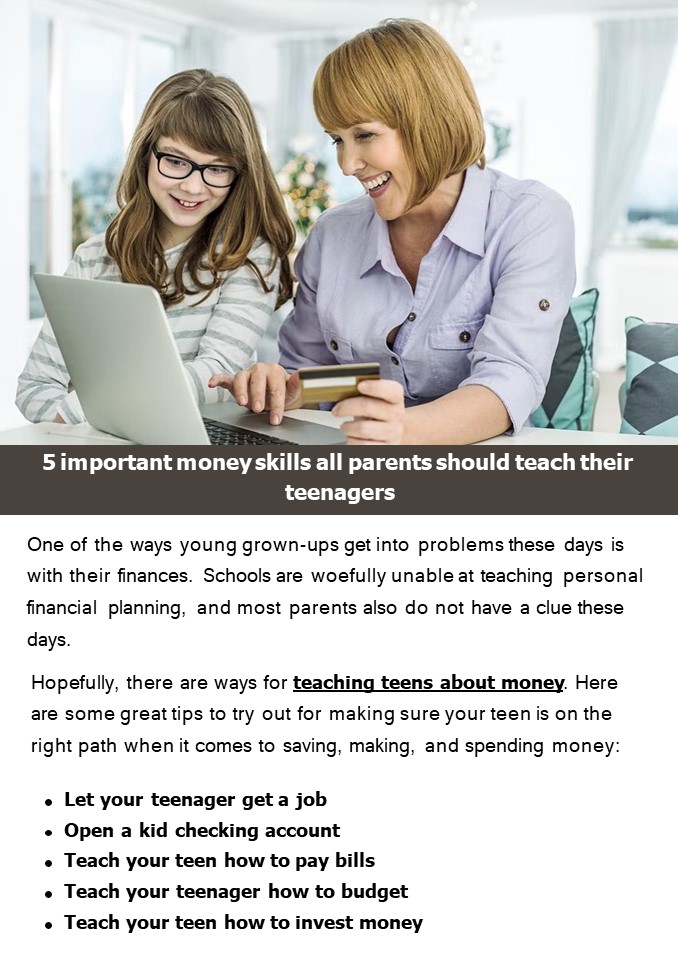

5 Essential Budgeting Tips for Teenagers

Learning to Manage Your Finances as a Teenager

As a teenager, managing your finances can seem like a daunting task. With the constant temptation to spend money on clothes, gadgets, and social activities, it’s easy to get caught up in the moment and neglect your financial responsibilities. However, developing good budgeting habits early on can set you up for financial stability and success in the long run. In this article, we’ll share 5 essential budgeting tips for teenagers to help you get started.

Tip 1: Track Your Income and Expenses

The first step in creating a budget is to understand where your money is coming from and where it’s going. Start by tracking your income from part-time jobs, allowances, or any other sources. Next, write down every single expense, including small purchases like snacks or entertainment. You can use a budgeting app, spreadsheet, or even just a notebook to record your income and expenses.

Income:

- Part-time job: $100/week

- Allowance: $50/week

- Birthday money: $200 (one-time)

Expenses:

- School supplies: $50/month

- Entertainment (movies, games, etc.): $100/month

- Food and snacks: $50/week

- Savings: 10% of income

Tip 2: Set Financial Goals

What do you want to achieve with your money? Do you want to save up for a car, college, or a big purchase? Setting financial goals will help you stay motivated to stick to your budget. Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

Short-term goals:

- Save $1,000 for a car in the next 6 months

- Pay for a school trip in 3 months

Long-term goals:

- Save for college tuition in 5 years

- Buy a house in 10 years

Tip 3: Categorize Your Expenses

Divide your expenses into categories, such as:

- Needs: essential expenses like food, shelter, and education

- Wants: discretionary expenses like entertainment, hobbies, and travel

- Savings: money set aside for long-term goals

- Debt repayment: money used to pay off debts, such as loans or credit cards

Allocate your income into each category based on your priorities and financial goals.

| Category | Allocation |

|---|---|

| Needs | 50% |

| Wants | 20% |

| Savings | 15% |

| Debt repayment | 5% |

Tip 4: Prioritize Needs Over Wants

It’s essential to prioritize your needs over your wants. Make sure to pay for essential expenses like food, shelter, and education before spending money on discretionary activities. Remember, it’s okay to indulge in wants occasionally, but don’t compromise your financial stability.

Prioritize:

- Pay for school supplies and tuition fees

- Set aside money for groceries and rent

- Use the 50/30/20 rule: 50% for needs, 30% for discretionary spending, and 20% for saving and debt repayment

Tip 5: Review and Adjust Your Budget Regularly

Budgeting is not a one-time task; it’s an ongoing process. Regularly review your budget to track your progress, identify areas for improvement, and make adjustments as needed.

Schedule regular budget reviews:

- Every month: review income and expenses

- Every quarter: assess financial progress and adjust budget

- Every year: review long-term goals and adjust budget accordingly

📝 Note: Be flexible and willing to make changes to your budget as your financial situation changes.

As you start implementing these budgeting tips, remember that managing your finances is a journey, not a destination. It’s okay to make mistakes and adjust your approach as you learn and grow. By following these 5 essential budgeting tips, you’ll be well on your way to developing healthy financial habits that will serve you well throughout your life.

By following these tips and staying committed to your financial goals, you’ll be able to achieve financial stability and success. Remember to always prioritize your needs over your wants, track your income and expenses, and review your budget regularly. Happy budgeting!

What is the 50/30/20 rule?

+The 50/30/20 rule is a budgeting guideline that allocates 50% of your income towards essential expenses (needs), 30% towards discretionary spending (wants), and 20% towards saving and debt repayment.

How often should I review my budget?

+It’s recommended to review your budget regularly, such as every month to track income and expenses, every quarter to assess financial progress, and every year to review long-term goals and adjust your budget accordingly.

What are some common budgeting mistakes to avoid?

+Some common budgeting mistakes to avoid include not tracking income and expenses, not prioritizing needs over wants, and not regularly reviewing and adjusting your budget.

Related Terms:

- Simple budget example

- Budget worksheet PDF