Maximize Your Refund with the 1040 Social Security Worksheet

Understanding the 1040 Social Security Worksheet

When it comes to filing your taxes, the 1040 Social Security Worksheet can be a crucial tool in maximizing your refund. However, many taxpayers are unaware of its existence or how to use it effectively. In this article, we will delve into the world of the 1040 Social Security Worksheet, explaining what it is, how to use it, and providing valuable tips to help you maximize your refund.

What is the 1040 Social Security Worksheet?

The 1040 Social Security Worksheet is a supplemental form used to calculate the taxable amount of your Social Security benefits. It is used in conjunction with Form 1040, the standard form for personal income tax returns. The worksheet helps you determine how much of your Social Security benefits are subject to income tax.

Who Needs to Use the 1040 Social Security Worksheet?

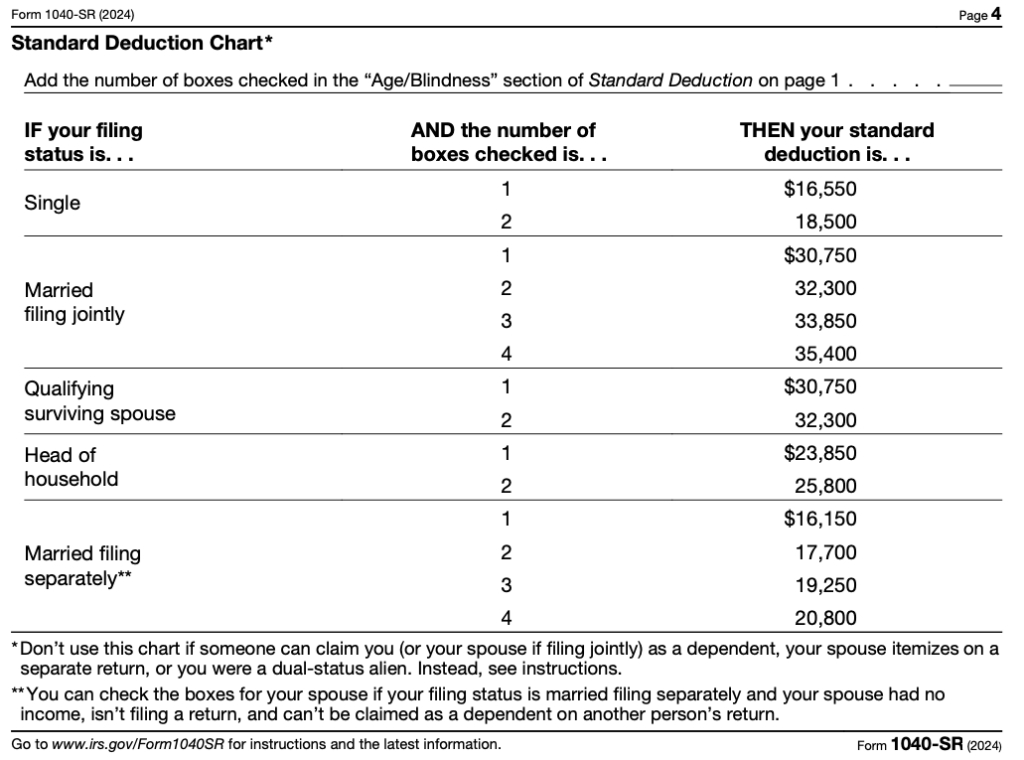

You will need to use the 1040 Social Security Worksheet if you receive Social Security benefits and your income exceeds certain thresholds. These thresholds vary based on your filing status:

- Single: $25,000 or more

- Married Filing Jointly: $32,000 or more

- Married Filing Separately: $0 (all Social Security benefits are taxable)

- Head of Household: $25,000 or more

If your income falls below these thresholds, you do not need to use the worksheet, and your Social Security benefits are not subject to income tax.

How to Use the 1040 Social Security Worksheet

Using the 1040 Social Security Worksheet involves a few simple steps:

- Gather your Social Security benefits statement (Form SSA-1099) and your tax return (Form 1040).

- Complete the worksheet by filling in the required information, including your Social Security benefits, adjusted gross income, and other relevant income.

- Calculate the taxable amount of your Social Security benefits using the worksheet’s formulas.

- Enter the taxable amount on your tax return (Form 1040).

Example of How to Use the 1040 Social Security Worksheet

Let’s say you receive 20,000 in Social Security benefits and have an adjusted gross income of 50,000. Using the worksheet, you calculate that 50% of your Social Security benefits are taxable. You would enter 10,000 (50% of 20,000) on your tax return as taxable Social Security benefits.

📝 Note: The 1040 Social Security Worksheet is a complex form, and it's essential to carefully follow the instructions and formulas to ensure accuracy.

Tips to Maximize Your Refund

While the 1040 Social Security Worksheet can help you determine the taxable amount of your Social Security benefits, there are other strategies to maximize your refund:

- Claim the Retirement Savings Contributions Credit: If you contribute to a retirement account, such as a 401(k) or IRA, you may be eligible for the Retirement Savings Contributions Credit.

- Itemize Deductions: If you have significant medical expenses, mortgage interest, or charitable donations, itemizing your deductions can help reduce your taxable income.

- Take Advantage of Tax Credits: Tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, can provide a significant refund boost.

Common Mistakes to Avoid

When using the 1040 Social Security Worksheet, be aware of the following common mistakes:

- Failing to report all income: Make sure to include all sources of income, including interest, dividends, and capital gains.

- Incorrectly calculating the taxable amount: Double-check your calculations to ensure accuracy.

- Not claiming eligible tax credits: Review your eligibility for tax credits, such as the EITC or Child Tax Credit.

Conclusion

The 1040 Social Security Worksheet is a valuable tool for maximizing your refund. By understanding how to use it effectively and following the tips outlined in this article, you can ensure you’re taking advantage of all the tax savings available to you. Remember to carefully review your tax return and seek professional help if needed to ensure accuracy and maximize your refund.

What is the purpose of the 1040 Social Security Worksheet?

+The 1040 Social Security Worksheet is used to calculate the taxable amount of your Social Security benefits.

Who needs to use the 1040 Social Security Worksheet?

+You need to use the worksheet if you receive Social Security benefits and your income exceeds certain thresholds.

How do I calculate the taxable amount of my Social Security benefits?

+Use the 1040 Social Security Worksheet to calculate the taxable amount of your Social Security benefits.

Related Terms:

- 1040 Social Security worksheet 2023

- IRS Social Security worksheet PDF

- IRS Social Security worksheet Calculator

- IRS Form 915 worksheet

- 1040-ss instructions

- 1040-SS 2022